A Global "Invisible" Niche-Market Leader at 5xPE and 15% Dividend Yield Which We Like

... And Keep Accumulating

In Competition Demystified, Professors Bruce Greenwald and Judd Kahn describe niche market leaders as companies that attain dominance by leveraging specific, durable advantages within narrowly defined segments. These advantages often arise from a combination of customer captivity, economies of scale, and the absence of vigilant, dominant competitors.

(Fig 1: Competition Demystified, a seminal book on corporate competition and sustainable competitive advantage, and Bruce Greenwald along with Warren Buffett)

These leaders, due to their dominant niche market competitive positions, are able to achieve a low cost basis, charge a premium, and earn sustainable excess return on their capital invested. Some western examples would be: Transdigm in the aerospace components space, Graco in the industrial fluid handling space, and Pool Corporation in the swimming pool products and services space.

(Figure 2: Long-term Equity Performance of Transdigm, Graco, and Pool Corporation)

These dominant niche-market leaders have been, without too many exceptions, long-term compounders. However, they also do not sell cheap. For instance, Graco sells for 28x PE, Pool sells for 27x PE, and Transdigm sells for a staggering 47x PE. At least on first glance, it is difficult to argue that these securities are dramatically undervalued.

Recently, however, as a result of the market turmoil, we have been able to gradually accumulate a sizeable position in one of the global invisible champions in its niche at a 5x TTM PE and a 15% TTM dividend yield. The company has more than 20% of its current market cap in net cash, and is managed by one of the finest management teams that we have met thus far.

Let’s take a deeper dive.

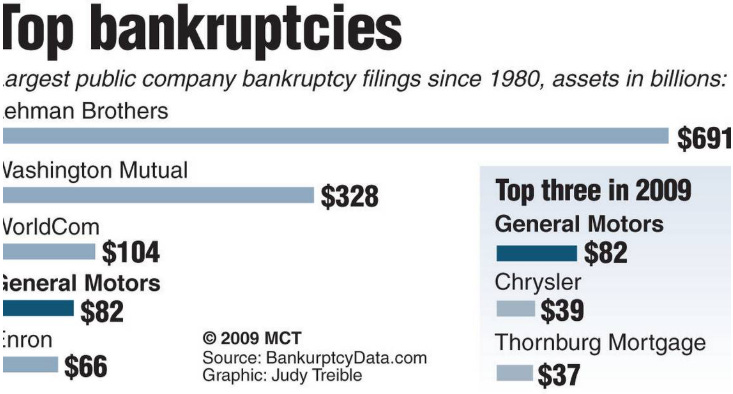

I came to the US in 2008, and what awaited me was the deepest recession since 1929. I still vividly recall watching news about General Motors’ financial distress while chewing a Subway sandwich in Houghton, Michigan.

As General Motors was going through financial restructuring, it was trying to save on every single penny. A then 6-year-old Chinese auto-parts supplier based in Hui Zhou (惠州), China, offered to pay for tens of millions of development costs for automotive molds to lessen GM’s financial burden. Ever since, GM has become an unshakable customer of this small Chinese company named Xin Point (信邦控股).

What does this puny Chinese company do?

(Xin Point Prospectus, page 132)

In a nutshell, Xin Point is a tier-2 automotive parts suppliers that supplies center console components, door trim panel, inner door handle, dashboard, steering wheel components, and gear shift panels.

(Xin Point Prospectus, page 135)

Procedurally, Xin Point helps auto OEMs with part design and development, mold design and fabrication, injection molding, electroplating/painting, and assembly, final inspection & global logistics. Electroplating is the key value-added of Xin Point, providing important features such as heat, pressure, and/or corrosion resistance as well as aesthetic appeal.

【For those of you who are not familiar with plastic electroplating, here is a short intro: After pretreatment of plastic molds (such as cleaning), the plastic parts are immersed in an electrolytic tank production line, where a metallic coating is electroplated onto the surface of the parts. This step takes approximately four hours, depending on the specified thickness. Xin Point have installed large electroplating tanks, allowing it to apply electroplated coatings to large parts. Xin Point is capable of performing various surface coating finishes, including mirror finishes, brushed metal finishes, black and titanium metal polishing finishes.】

Sounds “meh”? Here is a little additional insights.

Moats of Xin Point

Firstly, it is extremely difficult for an upstart to break into this field. One would need a massive clientele (Xin Point has more than 200 tier-1 and OEM customers, globally, covering almost the entire spectrum of players in the auto space) and a gigantic collective order to justify both the capital and labor intensive investments that have to be made. Each auto-part enumerated above costs less than 10 RMB, and without being the absolute dominant player in the field, profitability is simply hard to come by;

Secondly, customers are very sticky since these components are designed into their products years ahead and it is very difficult for them to switch a supplier especially considering the risk involved in both quality and safety. These components ensure mission critical attributes such as heat, pressure, and/or corrosion resistance, but are almost a negligible fraction of the customers’ BOM (bill of material). On the other hand, it is difficult for an existing player in one niche to break into another, even for Xin Point. For instance, even if the manufacturing techniques are similar, exterior products manufacturers face a different customer procurement group than interior products manufacturers;

Thirdly, electroplating (including advanced methods like nylon plating, and vacuum metallization plating) is a pollution heavy industry, and produces industrial wastewater that contains toxic materials such as hexavalent chromium ions. Therefore, there is literally almost zero production capacity of electroplated components in the US due to NIMBY (not-in-my-back-yard) — even if there are plants and equipment available, due to the highly technical nature of the production process, it will take years before there are enough skilled workers to fill up the labor intensive vacuum;

Fourthly, the fragmented industry has been in consolidation for decades. Environmental regulations pushed out smaller players, and large players kept consolidation the industry, lowering cost of production and increasing plant utilization. Although Xin Point is only about 7-8% of the global automotive plastic electroplating market, our estimate through expert calls and channel-based primary research is that it’s almost 30% of the higher-end auto plastic electroplating market. This enables multiple manufacturing advantages of Xin Point: 1). Each of Xin Point’s key electroplating production lines is equipped with an automated electroplating system with a master control console, capable of monitoring and controlling the flow and disposal of various chemical solutions; 2). Xin Point’s mold design capabilities are superior and involve multiple high-precision machining processes; 3). Xin Point’s injection molding processes utilize automated high-speed five-axis robots to enhance the precision, flexibility, and efficiency of the production flow. With these automated production lines, it can achieve high-quality standards, consistency, and production efficiency, while also optimizing labor utilization. In addition, the plethora of components that Xin Point is capable of manufacturing for its customers render it a valuable one-stop-shop for global auto OEMs with multiple brands and models.

Last but not least, because of all the aforementioned, the yield of Xin Point climbed from 90% (where the average in the industry was <80%, while the top 5 players in the industry averaged between 84-88%) in 2016 to an eye-popping 94.1% by 2024. Because the non-qualified components are non-recyclable, whoever has the highest yield is naturally endowed with the most competitive cost structure. Xin Point has been able to offer the best components at the most economically sensible price to its customers, and more customers accrue to Xin Point, including top EV players like Tesla, creating a powerful reinforcing loop, a rapidly spinning flywheel in the forward direction.

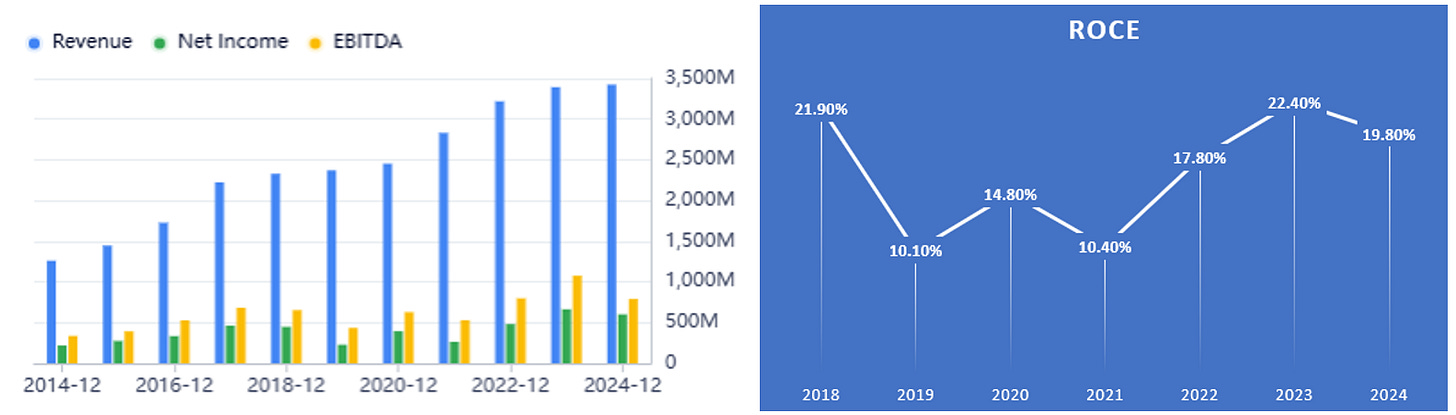

As a result, Xin Point has generated an average of 16.7% return on capital employed in the last 7 years, comfortably above its weighted average cost of capital of 8.5% in the same period. It has grown revenue, EBITDA, and net profit through a trade war, a pandemic, and one of the worst supply-chain crunches (and a Wuxi plant shut down & 2 fire accidents, among other idiosyncratic adversities). In 2016, it had 2.12 million square meter of production capacity and an 80.7% of plant utilization; in 2024, it harnesses 3.6 million square meter of production and an 84.2% of plant utilization, while increasing production yield by 400 bps as described. Plastic components are lighter than their metallic counterparts, and due to tightening emission standards, needs for better vehicle performance, as well as enhanced fuel efficiency & extended EV range, we believe the wind is at the back of plastic electroplating.

The Trade War

Since Xin Point has become public, despite doubling its revenue and profit, and without a single share of equity dilution, Xin Point’s equity price has actually declined by 7.56% as of last Friday’s close. Of course, if you held on to the stock, you already made your money back through dividend payouts, but a multiple compression of both P/E and P/B of 50% is incontrovertible. The trade war, coupled with the pandemic, excised a heavy toll on the global economy. Global passenger vehicle sales, inching up 1.7% in 2024 to reach 88.2 million, is still below the previous high of 94.5 million set in 2017.

And… how about that 100%+ tariff on China?

As early as 2016, seeing the potential of Mexico as multiple large auto OEMs set up manufacturing facilities there, Xin Point already started to make invests in the 7th largest auto market in the world. In its prospectus, Xin Point explained:

(i) As we expand our North American customer base, providing localized design, technical support, and after-sales services has become essential. This will significantly shorten delivery lead times to North America and improve responsiveness to regional customer requirements and market trends;

(ii) Building a factory in Mexico allows us to benefit from lower labor costs compared to North America and shorter shipping distances, which can help us reduce overall operational costs;

(iii) The Mexican government has introduced a number of preferential policies and incentive programs to attract foreign investment, including tax incentives, training subsidies, and support for commercial land use;

(iv) According to reports from authoritative institutions such as J.D. Power and IHS Markit, Mexico’s automotive industry is growing rapidly, and it is increasingly becoming a key global hub for Tier-1 suppliers and international automakers.

How about its competitors? Let’s take a look.

Tuo Xin (拓新), a private player in China, does not have manufacturing capacity out of China;

Min Shi (敏实), a public player with facilities out of China, does not compete in interior components (they primarily produces exterior components);

Jing Mei (精美), a private player in China, does not have manufacturing capacity out of China;

BIA, a European player, is in bankruptcy right now;

Gerhardi, a private player, has applied for bankruptcy protection.

Call that foresight. Now, our global invisible leader in plastic electroplating will be able to grab additional market share forced out of the hands of its main competitors — this is one of the great strategic positionings that we have been able to identify in the market.

By our estimate, Xin Point can currently absorb 30% of its US demand through its Mexican production line, and it is anticipating adding another line which will allow it to absorb 50% of its US demand. In addition, its Malaysian line is expected to come on line by the end of 2025, and can absorb another 10-20% of its US demand, substantially reducing the tariff impact. Assuming the 100%+ silly US-Sino tariff does not get revised down at all, we estimate Xin Point, barring a severe global industrial and consumer recession, is capable of generating a 480mm HKD net profit which will be growing. This translates to a 6.6x P/E, still dirt cheap for a high-quality, dominant niche player on a global basis. Xin Point has guided for 200mm HKD of annual capital expenditure and a desirable 500mm HKD net cash on its balance sheet. After the current dividend payout, it will have no need to accumulate additional cash to hit that 500mm HKD net cash goal, and any additional free cashflow after annual capital expenditure can be distributed back to us shareholders, translating to a normalized 8.8% annualized dividend yield even under our direst forecasted scenario.

Risks:

Firstly, this is NOT an investment recommendation. We simply hope to share some of our primary/secondary research and hopefully may get some constructive feedback. Please do your own research and due diligence;

Secondly, should a global escalation of trade war materialize, or should a US-Mexican and/or US-Malaysian tariff be carried out, our normalized earnings estimate for Xin Point will turn out to be optimistic, and the stock can rerate lower;

Thirdly, new competition could emerge, and new technologies such as PVD (physical vapor deposition) and/or IMD (in-mold decoration) see major breakthrough that render electroplating uncompetitive could pose existential crisis for Xin Point;

Fourthly, Xin Point is a thinly traded security in the Hongkong market. Nearly 75% of its shares are held in the hand of its founder, Xiaoming Ma, while another 5%+ is held by Guanqiu Huang, a famed Chinese investor. It is not in the Shanghai/Shenzhen — Hongkong connect, and if one accumulates a large position in the stock, it can be difficult to liquidate under a fire-sale scenario;

Lastly, a global recession due to a large-scale, escalating trade war will obviously negatively impact consumer sentiment and purchasing power, resulting in short-to-intermediate term headwinds, but we believe Xin Point is positioned to survive and thrive, and risks of permanent capital loss are limited, if not negligible.

Great article! Two questions:

1. The company mentioned 30.7% revenue coming from US, how does that number roughly translate into profit? Most likely US customers provide the highest margin, so Xinpoint's profit gets hit harder than revenue.

2. Based on the "industry competitor analysis" section of this article, it seems there's almost no viable Non-Chinese alternative vendor for these plastic parts -- is that really the case? If true then logically Xinpoint has a strong leverage over its US customers and the tariff burden can be potentially transferred, especially considering the total cost of these parts is a small fraction of the overall BOM.

Thanks for the sharing.

Has your opinion changed after Xinpoint announced that selling is by DDP?