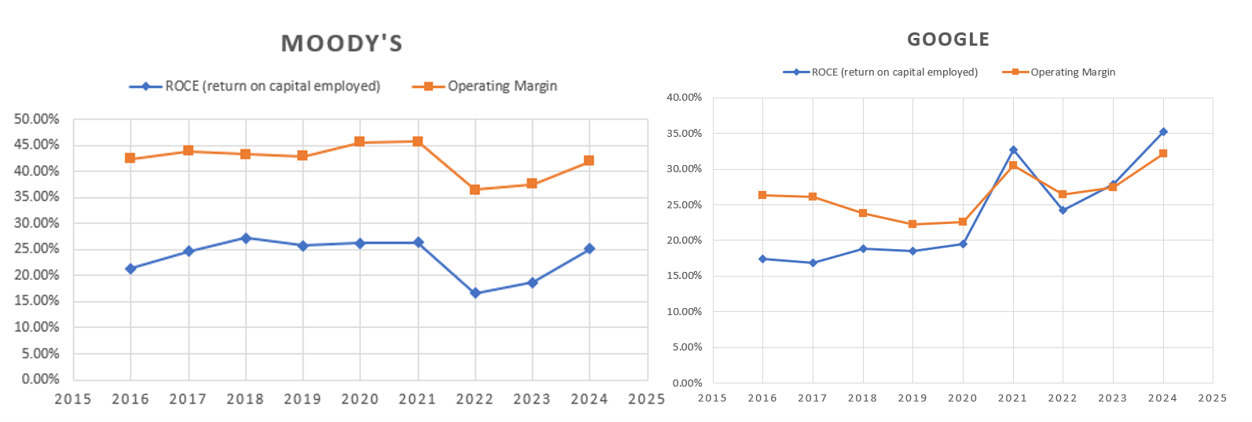

A canonical value investing textbook will characterize competitive advantage (the proverbial “moat”) as a firm’s ability of maintaining a stable market share, and sustained profitability (return on invested capital (ROIC), operating margin, etc). This notion well captures some of the most “moaty” enterprises in the US. For instance, below you can find the ROIC and operating margin of Moody’s and Google (sources: FactSet):

For US companies operating under a duopoly or a close-to-natural monopoly market structure, ROIC and operating margin tend to be high and steady, compounding shareholder value in a peaceful and pleasant manner.

While I concur that the simultaneous exhibition of these traits are indicative of sustainable competitive advantage, I argue that the notion of competitive advantage may need some minor adjustments especially for rapidly evolving industries and fast developing emerging markets. As a matter of fact, our experiences taught us that competitive advantage for emerging market companies evolve fluidly and should therefore be assessed dynamically. Oftentimes, their operating margin and profitability suffer precisely as they cement their market power and creating formidable barriers of entry.

If this sounds somewhat hazy, let’s see a concrete example, a company we successfully invested in and exited last year.

Luckin Coffee

Luckin, sometimes nicknamed “the Starbucks of China”, enjoyed a monstrous ride since Centurium took over and replaced some key executives after its 2020 financial accounting scandal.

With highly successful new product introduction (such as coconut latte) and efficiency improvements, its scale and profitability both soared in 2023. Back in Q2 2023, Luckin set per cup price at or above 15 RMB, and its lucrative business model attracted a lot of competitors. One of them was Cotti, founded by the ousted former Luckin chief, Zhengyao Lu (陆正耀). Leveraging a capital-light franchise model, Cotti quickly expanded to 5,000-6,000 stores, threatening Luckin’s dominance. Luckin responded by aggressively expanding stores, more than doubling its store count from 8,000 to 20,000 in a bit more than a year. Meanwhile, it lowered its per cup price to 9.9 RMB especially at stores close to Cotti. The dilution of its per store sales due to rapid expansion, coupled with lower per cup price, led to dramatically reduced profitability and return on invested capital. Notably, in Q1 2024, Luckin’s operating margin turned negative (-1.42%).

Based on canonical value investing theory, this is a prototypical example of lacking competitive edge. One competitor’s entry completely thwarted the incumbent’s profitability – what could be a worse set-up of competitive landscape?

Nevertheless, I argue that based on the “theory” of dynamic competitive advantage, Luckin was actually building a power economic moat, much stronger than its former self back in 2022-2023. In emerging markets, especially uber-competitive ones like China, competitive advantage needs to be assessed based on cross-cycle equilibrium. 15 RMB/cup was not sustainable because it allowed its competitors who undercut it by 1-2 RMB/cup to expand and thrive. Based on lots of on-site leg-work we have done last year, Luckin’s per cup cost was less than 10 RMB and therefore with a price range between 15-16 RMB/cup, its per cup profitability was 5-6 RMB. Cotti, among other entrants, leveraged a franchise model where most of its franchisees made 2-3 RMB/cup to undercut Luckin and rapidly expanded, posing a tangible threat to Luckin.

However, when Luckin targeted Cotti, lowering its per cup cost to 13 RMB on average and sometimes less than 10 RMB/cup when the stores are close to Cotti (about 25% of its stores), it essentially eliminated all profit for its competitors, effectively stalling Cotti’s expansionary momentum. At an average per cup of 13 RMB, taking advantage of its operational efficiency and scaled economy, Luckin could earn a low double digit return on invested capital; its competitors, however, faced existential dilemmas. These competitors could lower prices to boost volume, but they could not cover per cup costs; alternatively, they could maintain a higher price, but volume could not support per store economics. For example, when ASP (average sales price) of Luckin was at 13 RMB/cup, Cotti was selling at an ASP of 12 RMB/cup, but its volume was half of Luckin’s. Many franchisees we talked to last year chose Cotti because Luckin wasn’t able to offer franchisee quotas to them in the first place. Cotti’s competitive threat turned out to be a boon for Luckin:

Firstly, under Cotti’s pressure, Luckin quickly expanded its number of stores to 22,000 by Feb 2025, leaving everyone else in the dust while occupying the prime locations that are well positioned to take advantage of incremental market penetration;

Secondly, the lower price per cup educated consumers, speeding up the education and therefore market penetration of coffee among Chinese consumers;

Thirdly, the lower price environment converted a “red sea” into a “blue sea” as capital left this space and new entrants hesitate to join the “dog fight”, effectively reducing competition, leading to higher profitability to the incumbents.

Last but not least, Luckin now boasts the largest host of physical stores and a most powerful channel to unlock new products and even new product categories. For instance, it released Qing Qing Mo Li (轻轻茉莉) last summer – “morning coffee, afternoon tea”, the tea category effectively complemented Luckin’s coffee offerings, and coupled with its powerful and expansive distribution channels, quickly enhanced its renown and boosted its per store profitability. In August 2024, the data we tracked indicated 60-80 cups of additional daily sales per store for Luckin due to Qing Qing Mo Li. Due to its scale, it could afford to invite Yifei Liu (刘亦菲), one of China’s widely followed actresses (TBH, I’m also a fan..), to represent its product.

After understanding the dynamically strengthening competitive advantage of Luckin despite a low-profitability façade detested by the market, we built a position in Luckin last August-September, reaping capital gains for our investors as the market come to our conclusion.

We carry these lessons with us as we move forward in our investment journey, and I hope to illustrate our understanding with another example -- a recent addition to our portfolio which we believe are attractively priced if one takes the long view.

Meituan

Armed with such an understanding, we recently rebuilt a long position in one of our largest longs early last year, Meituan. The set-up was strikingly similar to Luckin – new entrants, namely JD.com and E-Le-Ma (owned by Alibaba) aggressively entered the delivery space, pressuring Meituan to partially match their aggressive pricing, leading to temporarily depressed profitability and return on investments.

Meituan reported its 1Q earnings yesterday, and handily beaten both topline and bottom-line estimates by a wide margin. Nevertheless, during the conference call, Xing Wang, Meituan’s philosophical Chairman, decided not to provide guidance for Q2 2025:

On the financial front, we anticipate volatility due to heightened competition. I expect no one will be surprised by short-term fluctuations in financial performance, as other platforms continue to maintain high subsidy ratios, a trend that may persist. We will increase investments while adhering to the principles of fair and orderly competition, with the overarching goal of fostering healthy industry growth and defending our market position. We will also honor our commitment to invest more in the ecosystem. Since most of these investments will be recorded as revenue deductions, we expect the year-on-year growth rate of Core Local Commerce revenue in Q2 to slow compared to Q1, and operating profit for Core Local Commerce to decline significantly year-on-year.

It’s unclear how long the irrational competition from new entrants will last, so we cannot provide precise financial guidance for Q2 or the remainder of the year at this stage. Nevertheless, we will continue to defend our market share.

While some are frightened by Xing Wang’s belligerent stance, we took advantage of market’s fear to establish a contrarian position because we have seen this movie before and we vividly remember market’s disgust when Luckin threatened Cotti with a 2-year-long campaign of 9.9/cup. Our notion is the following: when the competitor trespassing your backyard, obviously you fight back. We agree with Xing 100% that he should valiantly defend his market share, just like what he did with Tik Tok a year ago.

Firstly, we do not believe JD.com’s financials can support a prolonged warfare. As a matter of fact, we surmise JD.com to lower its suicidal investments in deliveries after its 618 (June 18th) promotions – historically, Qiangdong Liu has been willing to admit his “mistakes” and he has consistently been someone who cared about corporate profitability.

Our channel checks indicated that per order losses for JD.com is on the order of 8-10 RMB. Coupled with 15 million orders per day, JD.com loses 135 mm RMB per day, and 4 billion RMB per month. Annualized, this translates to roughly 50 billion RMB of losses, amounting to a staggering 86% of JD.com’s operating cashflow last year. Deliveries is an infrastructure-heavy, data & algorithm-heavy, and operations-heavy space — it will take JD.com a long time to collect enough data and consumer feedback to better its currently lackluster fulfillment capabilities, while still at only 1/5 of Meituan’s scale – as a matter of fact, we believe Meituan, with its triple-sided network effect, harnesses one of the most powerful economic moats we have ever seen.

Secondly, the subsidies for deliveries, just like those 9.9 RMB/cup promotions, cultivate consumer habits, increase market penetration, and ultimately benefit the dominant incumbent, namely Meituan, once the warfare subsides. JD.com’s vocal PR also helps to de-risk Meituan’s political threat as it proactively attends to the social securities issue of the riders. Our most pessimistic estimate of its negative impact is 43 cents per order by 2027. While this is obvious a unpalatable drag, we believe Meituan has substantial room to raise its per order take-rate (don’t even think about comparing it with Doordash…) and Meituan’s current earnings power is, in our view, considerably masked by a deflationary consumption environment in China.

Thirdly, one potential cause of JD.com’s aggressive entry into the delivery space is believed to be Meituan’s successful foray into the “Instant Purchase” space. In Meituan’s press release, it wrote,

In Q1 2025, Meituan Instant Purchase maintained strong growth momentum, won consumer acknowledgements, and exhibited tremendous growth potential. Multiple product categories experienced substantial growth, including beverages, snacks, 3C products, home appliances, beauty products and etc. On Valentine’s Day, number of orders doubled, flowers, appliances, jewelries, and beauty products have been favored by the young generation.

While these developments are currently effectively neglected by the market due to fear, when greed comes back and these new initiatives further mature, Meituan should enjoy a premium, not discount, in terms of valuation.

Lastly, one key attribute of “dynamic competitive advantage” is constant threats from competitors. “Prosperity grows from adversity, and ruin lurks in comfort” (生于忧患,死于安乐). Luckin attracted competitive entrants as it rested on the laurel of lofty pricing and high profitability. Throughout its corporate history, Meituan had to constantly fend off competitors – “the war of a hundred”, Tik Tok’s encroachment of its turfs in 2023 and early 2024, and now JD.com’s challenge of its dominance in deliveries. These competitive threats ensure Meituan maintains one of the most powerful armies, and its armada is now sailing overseas like that all-conquering Alexander the Great, and our channel checks came back to us indicating Meituan’s opponents were still operating like Meituan’s former Chinese competitors a decade ago. We look forward to more good news coming from the overseas front.

(Keeta, Meituan’s overseas brand, entering Brazil, where we believe the motorcycle-taxi ecosystem is synergistic with Meituan’s core competence of deliveries. )

We controlled our position size since Meituan is effectively trading at 15x normalized PE (quite a bit more expensive than when we bought Meituan early last year at less than 10x) and we have many other favored positions vying for a portion in our portfolio, but we hope to share our hypothesis of “dynamic competitive advantage”, and invite you to be a witness of how the thesis plays out.