Q1 2023 Letter: Close to Our Anniversary

Regional financials present attractive opportunities for stock pickers

Dear Readers:

In the first quarter of 2023, our return after all fees, expenses, and carry turns out to be 8.44%, while S&P returned 7.46%. We have beaten our benchmark every quarter since the launch of the fund. Below are our cumulative net return and our sector exposure. As you can see, we are over-weighting financials. I will discuss the rationale behind the overweight later in our letter. Our cash position by the end of the quarter is 16.7%.

We are negatively impacted due to our financial exposure coming into the banking crisis, while we are helped by the media sector (categorized in the communications sector) for its 1Q outperformance – it has been our largest detractor last year. Such is life. Sometimes it blows headwind, sometimes tailwind.

In 19 days, I will be running our portfolio for an entire year. What a year!

The market continues to climb on a wall of worries, and now the headline concentrates on regional banks. They just got past the liquidity crunch, and now everyone’s worried about credit risks given regional banks hold 70% of CRE (commercial real estate) loans.

I guess the most visceral headline fear I have experienced still belong to the March of 2020. When Saudi declared price war with Russia, a major oil producer’s derivatives trader who has been in the industry for more than four decades that I deeply respect uttered the famous sentence: “the coffins are lined up”. We all know what happened later.

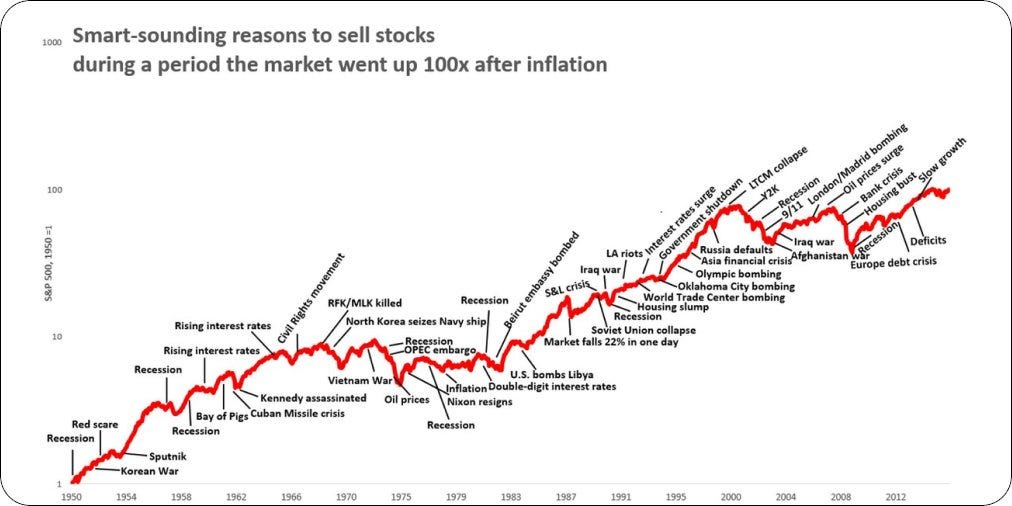

It is my highest duty and responsibility to try to ensure you are able to weather the storm of various markets and sail with me to arrive at the other side. We will make a lot of money over time, but we need to stay on the table until that day. I try to remind you constantly of the following chart:

Picture 1: The market’s progression in the last 72 years and corresponding headline “risks” throughout.

The patient investor is rewarded with the best fruits of the market for being able to weather short-term volatility. Let the smart cookies worry about this and that and do all sorts of smart hedging maneuvers. The chess master has no genius stroke throughout the game, and a real investor has no thrilling “stories” to tell.

Regional Banks

We have a decent sized portfolio of regional banks. Here is the overarching thesis:

1. Regional banks serve the critical function of diversifying systemic financial risk in the US, adding resilience to the banking industry as a whole.

2. While mega banks are able to handle cookie-cutter functionalities to customers with simple needs, their bureaucracy is badly set up to deal with customized services that the customers request. For instance, an individual with a simple W-2 might find peace with Bank of America, while a sole-proprietor with 3 real estates and 25 employees will find it insane to get anything done with the Big Four. One regional bank’s CFO told me a customer that stayed with Wells Fargo for 80+ years migrated to become their clients as she simply could not get Wells Fargo to send documents in electronic forms (vs. paper forms).

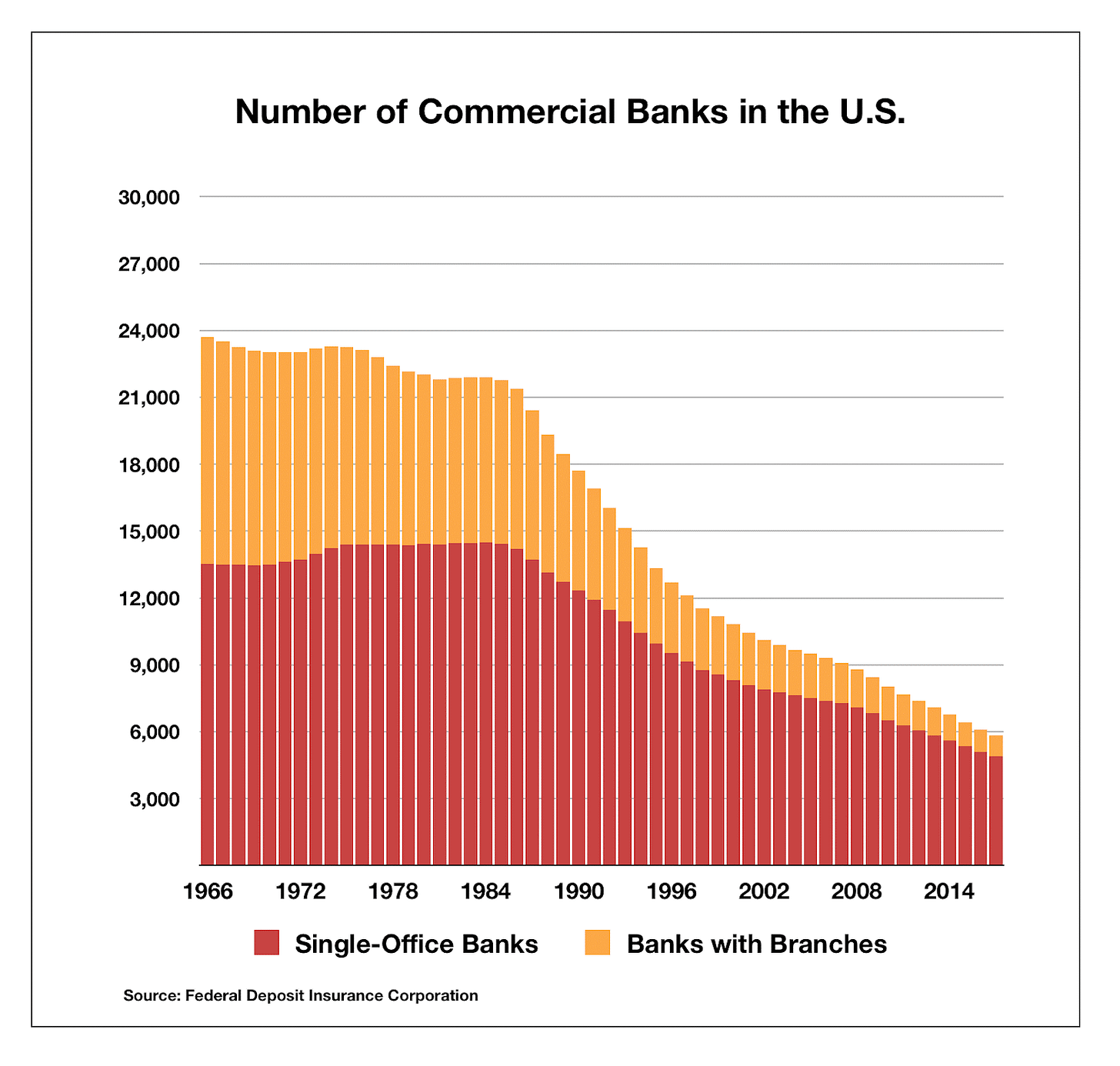

3. As we can see in the graph below, in the last 60 years, the regional banks industry has gone through rapid consolidation, especially since the late 80’s. With capital flight that is happening right now in the industry, I imagine the pace of consolidation will accelerate. Well capitalized consolidators have a long way with sticky snow ahead to become a much bigger snowball in the foreseeable future. It is almost identical to what happened after the 2020 oil debacle. Consolidation happens when capital withdraws from an industry. Excess return is the friend of a scarcity of capital, and the enemy of abundance.

Figure 2: Number of commercial banks in the US from 1966 to 2017.

Protection of low valuation for some of the best managed regional banks with no liquidity risk and manageable credit risk even if a credit crisis materializes.

In March, with the collapse of Silvergate, Signature, and Silicon Valley Bank, everyone suddenly start to keep a close eye on maturity mismatch, leery of banks that took deposits in 2020-2022, and invested the proceeds into securities with long maturities.

Not everyone does things in that way. Here is an excerpt from an outstanding CEO of a regional bank we currently hold:

“With a lack of loan demand during the year, many peers chose to invest a greater proportion of their excess cash into investment securities. It is notable that during the year, we chose to avoid following suit given the historically low rates of interest that did not seem to compensate us for the risk that rates might rise in the future. In essence, we decided it was better to hold our fire. A hypothetical $10 billion invested in a three-year US Treasury bond yielding 16 bps at the start of 2021 would have earned $3 million in incremental interest income during the year; however, that would have been accompanied by a $234 million decline in market value and thus a reduction in equity, as rates came off their lows. We made this conscious decision to avoid risking our shareholders’ equity and, ultimately, we believe they will appreciate that patience.”

See, some executives do care about shareholders. We would love to be partners with them. This bank generated 16.9% ROTCE (return on tangible capital employed) over the last ten years, and we snatched up the shares at 1.31x PTBV (price to tangible book value). In addition, although it has a large exposure to CRE, its underwriting culture and record is perhaps one of the best, if not the best in the entire industry. We choose to trust them. We own several other regional banks and a regional bank preferred. I have discussed some of them before, and we will not repeat due to limited space.

We believe we will make a lot of money on them.

Property & Casualty Insurance

Some of you might be surprised that our current largest holding is a P&C insurer in China. Please let me explain.

Figure 3: P&C insurance industry market share in the US. (Source: Statistica)

The US P&C industry, despite years of consolidation, is still highly fragmented.

The Chinese P&C industry, however, is an oligopolistic market, with remarkably stable market structure among the top three players.

Figure 4: Chinese P&C Market Share Structure from 2014 to 2022. (Source: Wind)

It has been extremely difficult for new players to break in, given the fourth player is only 1/3 the size of the third player. In addition, although the second player has been aggressive in trying to expand its market share, it met significant difficulties in encroaching the top player’s market share. We do not like competition – competition is a destroyer of shareholder capital, while monopoly compounds it. Consequently, the top player, also one of our largest holdings, maintains a 97-98% combined ratio, and its ROE (return on equity) constantly hover at 12-15% over the past decade, substantially exceeding its WACC (weight average cost of capital). Last but not least, it is by no means a slow grower.

When we bought the stock, it was trading at less than 6x PE (price to earnings ratio), and sported a close to 7% of forward dividend yield. The opportunity existed because investors worry the Chinese reopening could lead to outsized auto-collision, leading to a negative impact on profitability. We are patient, and we love time arbitrage.

The annual report just came out, and its bottom line advanced by 19% despite a more than doubling of its loss provision.

We think we will make a lot of money off of it.

Conclusion

Every time the Fed hikes, something breaks. We will stay vigilant, and snatch up cheap deals for our investors on a going forward basis. The fascinating treasure hunt drones on.