Q3 Investor Letter -- Poised for Capital Appreciation

Well-positioned in the longest historical decline of Hang Seng Index

Dear Readers:

In Q3, 2023, we delivered a positive return of 2.27% net of expenses, fees, and carries, while our benchmark, S&P 500 declined by 3.35% (inclusive of dividend). Our year-to-date net return is 12.9%, slightly trailing S&P’s positive return of 13.1% (inclusive of dividend). Since inception on April 19th, 2022, we have outperformed S&P 500 by 30.2%. We believe the true worth of our portfolio is not being fully recognized by the market yet, and we believe we are poised for further capital appreciation.

Our portfolio advanced by 6.44% in July, led by selected securities such as PDD, BEKE, Luckin Coffee, and our regional bank exposure (which we have discussed in earlier letters). We have since either trimmed or sold out these positions. We have further increased our risk exposure to the Hong Kong market, and its continuous decline dragged our August and September return to -4.07%.

Overview of Markets, China and U.S.

We are going through the longest annual losing streak in the history of Hang Seng index, and we believe our holdings are substantially undervalued by the market. The 2Q earnings report are all out, and most of our holdings are either grabbing market share and/or growing, yet their valuation is compressed further. For instance, a dominant tractor company we owned (First Tractor, HK 0038) had 7.2 billion in revenue (10% YoY growth) and a profit of 750 mm in net profit (29% YoY growth). Its tractor ranks the #1 in China with a 25%+ market share. It currently trades at exactly the net cash on its balance sheet at 3.6 billion RMB. Even without the 3.6 billion RMB net cash, the stock trades at less than 5x PE with a close to 7% dividend yield. We think this is nuts.

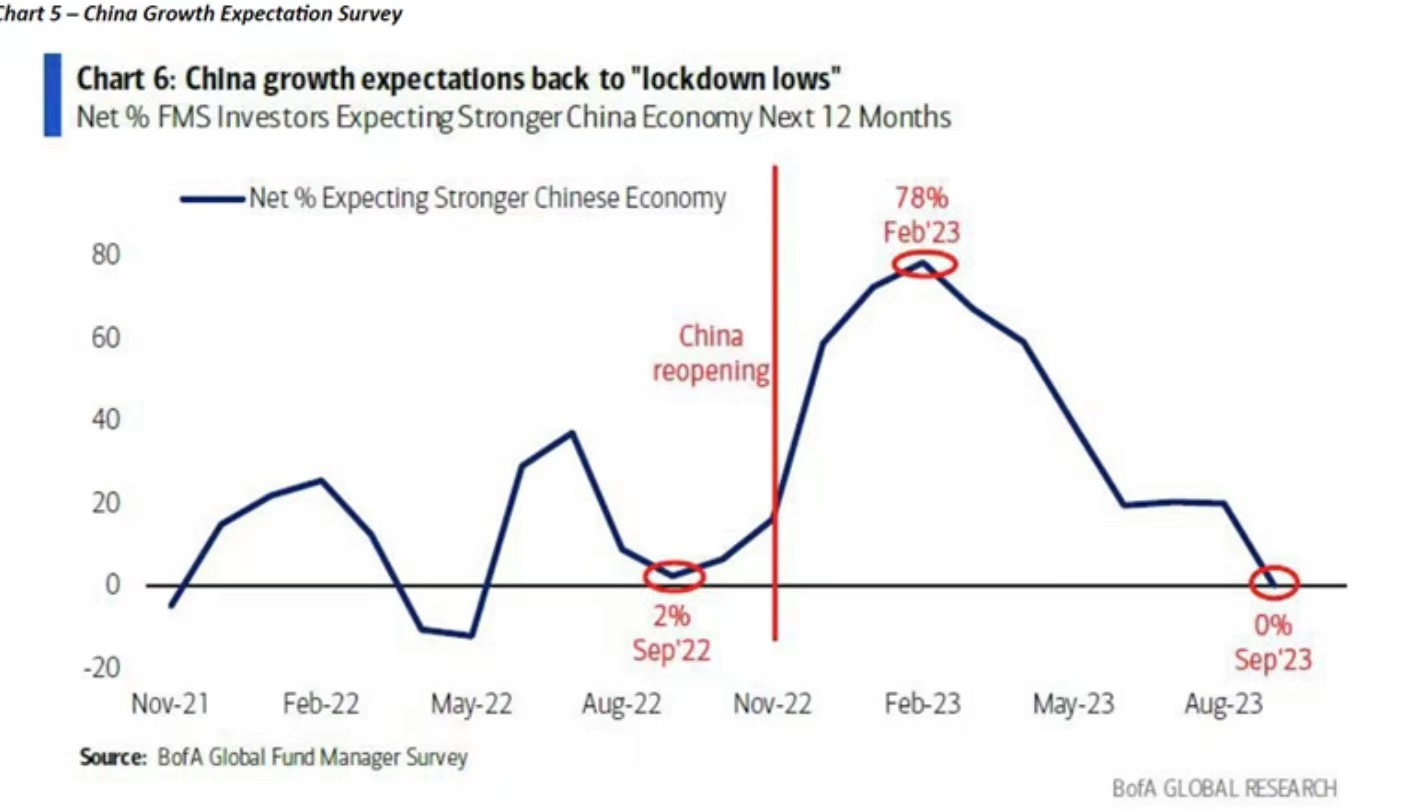

Figure 1: China growth expectations expressed by Net % Expecting Stronger Chinese Economy. (Source: Bank of America Global Fund Manager Survey).

The growth expectation for China is back to “lockdown lows”.

Figure 2: China cumulative active equity flows by Europe and US domiciled funds. (Source: EPFR Global Country Equity Flows Database).

Foreigners who rushed to scoop up Chinese assets at the beginning of the year, chasing after the “reopening” play, are now bumping against each other exiting the front gate in haste. We still fail to understand how Apple and Tesla can trade at 30x and 65x PE, respectively, if China blows up. We have covered our short in Apple at a minor profit, and we continue to short Tesla, which we believe, with 4Q 2023 results showing a tangible slow-down in YoY growth, is a busted growth story.

While we find many attractive opportunities in Hong Kong, we are not bailing out of the US — not even close.

Figure 3: S&P 500 year to date performance vs its performance adjusted by equal weights.

On an equal weighted basis, S&P 500 is essentially flat this year. The multiple expansion among the largest companies in the US does not do justice to revealing the overall market condition. We are able to find multiple interesting companies with double digit free cash flow yield and strong growth characteristics. The valuation-gap between large cap and SMID cap is reaching a decade high. Again, we do not quarrel with the tape — we focus on the per unit economics of our capital and hope to optimize it.

Our Largest Long — CSPC Pharmaceutical

CSPC Pharmaceutical is experiencing multiple headwinds and is trading at a historically cheap valuation. Naturally, the first question we ask ourselves is: why does the market sour on CSPC?

We believe the explanation has two parts, one macro-driven, and one idiosyncratic.

The macro-driven reason is that the entire pharmaceutical sector in China is undergoing an anti-corruption campaign, resulting in multiple compression for the stocks. Some sales representatives were arrested (with some pictures showing these representatives being taken away from the airport), and the market worries that this could lead to weakened drug sales for pharmaceutical companies going forward.

The idiosyncratic reason is CSPC’s largest drug, NBP (恩必普), is approaching patent expiration, therefore facing generic competition. Two other drugs with large revenues, namely nab-paclitaxel (白紫) and PEGlyated recombinant human granulocyte colony (津优利) are undergoing centralized purchasing (集采), therefore facing substantial pricing pressure.

The question for us is whether the market is wrong.

We believe the anti-corruption campaign is conducive to the solidification of large pharma’s competitive positioning, so it actually plays to CSPC’s advantage. In the past 20 years, the entire sector has gone through aggressive growth and disorderly competition. The experts we talked to told us that there was a time when so many drug could become public and reach large scale of sales. Standards were exceptionally low. The current campaign aims to weed out those who lack true innovation capacity. We have seen this movie being played out in many industries before, so it’s déjà vu for us. Ultimately, a rising standard, just like the Supply-Side Reform back in 2015-18, leads to a consolidated industry, resulting in both higher profitability and greater market share for the incumbents with scale advantages. CSPC has grown its R&D by 20% this year and its R&D spending is approaching those of the innovative drug leaders such as Hengrui Pharmaceutical, yet CSPC trades at a fraction of its innovative drug peers. Actually, CSPC could have held R&D flat in 1H 23 to come out with a double-digit growth in its EPS (vs currently being flat), but it chose to go all in on R&D, forfeiting short term profitability for long term growth.

If the anti-corruption campaign is not an explanation for CSPC’s historically low valuation, it has to be something else. The revenue collapse of the two drugs undergoing centralized purchasing have already been reflected in 1H 23’s results. Now, NBP is indeed the largest cash cow for CSPC, and its injection form (注射剂型) is 4.5 billion RMB, while its capsule form (胶囊剂型) is 2.3-2.5 billion in terms of revenue. However, it is not a reference medicinal product (参比试剂) yet (which prevents direct manufacturing and selling of generics from its competitors for now), and those who want to sell generics of NBP would have to go through “Requests for Comments” (征求意见稿), which has high standards as well. As a matter of fact, CSPC is likely to experience growth rather than contraction in its NBP in 2024 and possibly 2025 as well. The management actually telegraphed to the market that NBP will grow at mid-single digit for the next two years. Further, CSPC is emphasizing the retail channel for its capsule form NBP, because the retail clients who care about brands are much less likely to choose its generic alternative, exhibiting much better customer stickiness compared to injection form. That leaves us with 4.5 billion RMB of potential threat on its NBP injection revenue after 2025 – still a full 15% of its 2022 revenue.

However, the market can be myopic and overly focused on one negative issue, while being completely absent-minded about the positives, especially in a bear market (the reverse is true for a bull market). We believe the market is completely ignoring CSPC’s diverse and powerful pipeline with strong candidates that can replace the revenue loss from NBP. RhTNK-tPA (铭复乐), a biological drug used to treat acute ischemic stroke (急性缺血脑卒中, which is 80% of all ischemic stroke) become public late last year and has got another indication for acute myocardial infarction. The drug is used within 4-5 hours of ischemic stroke, and then the patient is sent into the hospital for rescue, and after the patient comes out of the hospital, she takes the capsule form of NBP for full recovery. CSPC is also applying for an extended efficacy form of RhTNK-tPA with 24-hours of coverage. In all, this drug has the potential of reaching 2-3 billion RMB at the peak. Meloxicam (美洛昔康纳晶), a chemical drug used for non-opioid postoperative administration of analgesia (非阿片术后止痛剂), can be used for injection with a massive total addressable market, and CSPC is the first Chinese company to come out with this drug. It is estimated to reach a 3 billion RMB peak sales. These two drugs in the neurology segment of the business shall fill the void of NBP, not to mention FcRn target Batoclimab (巴托利单抗), which has 5-10 indications including myasthenia gravis (重症肌无力). Our estimate is that CSPC’s pipeline will not only offset any loss from NBP but will start a long period of low double-digit growth in its revenue.

CSPC has no debt, and sits on 15 billion RMB of cash. It generates ~5.5 billion free cash low and this likely grows at low double digit. Its market cap is 63.2 billion RMB, so on a net market cap basis, it’s trading at low double digit free cashflow yield. Given its doubt-digit growth potential, our conservative fair value estimate for the business is 8.2 HKD/share, or 44% higher than its current price. The company just hiked its mid-term dividend payment by 40% YoY, showing its shareholder friendliness, and it has the financial strength to ensure steadily increasing shareholder return and pipeline development either through internal R&D or through BD (business development). Dongchen Cai (蔡东晨), the Chairman of CSPC, holds 23.74% of the company and is aligned with shareholders. He also has capably transformed CSPC from a bulk drug producer into a first-generic and innovative pharmaceutical company starting more than a decade ago, leading to a 10x of the stock price. We believe an aging society like China will need innovative pharmaceutical companies with both economy of scale and intangible assets (in the form of patents and innovative knowhow). We’d love to be partner with this management team and ride their coattail of their transformation from generic to a global branded drug powerhouse.

We continue to like WH Group and Conch Cement after their midyear report. WH Group will likely pay off all the debt at the parent level by the end of this year and start to buy back their shares next year, and the cycle is also turning due to reduced production capacity in the US; Conch Cement generated incrementally higher operating cash flow YoY, and still has 50% of the entire cement industry’s profit, demonstrating peerless competitive edge.

Our Largest Short — Digital Realty

Our largest short position is Digital Realty (DLR). The company has $17.7 billion debt, and $17.2 billion of it is unsecured. Debt/EBITDA as of Q2 2023 is 6.8, and EV/EBITDA is at ~20.5x. The current blended interest rate on its debt is 2.5%, and starting from next year the company will have to start to roll over $1 billion of debt each year. Notice the debt issued by Apple is currently 5%, and the prime rate among US banks is already 8.5%. In short, the financing cost of the business is likely to substantially increase going forward.

To give some color in terms of its valuation – Google is trading at 16x EV/EBITDA, and Amazon & Microsoft trade at 22x. Make no mistake, Digital Realty, with a 7x debt/EBITDA balance sheet, is trading on par with Google, Amazon, and Microsoft, a group of companies who are the true beneficiaries of the AI age, a group of company with pristine balance sheet and strong growth potential.

Does this make sense? Is this company profitable?

In the last three years, the company’s operating cashflow has been $1.7 billion, $1.7 billion and $1.66 billion, while its capital expenditure has been $2.06, $2.52, and $2.64 billion dollars, respectively. In other words, the company burns $400-900 million dollars of free cashflow. Does this large capital expenditure result in growth? In 2022, the per-share revenue of DLR is $16.4, and in 2020 it was $15. In other words, despite being a Covid beneficiary, the compounded revenue growth rate for DLR has been only 3%! In addition, to sustain its mirage of a “dividend aristocrat”, the company distributed $1.24, $1.38, and $1.45 billion dollars of dividend through increasing their leverage at unsustainably low interest rates.

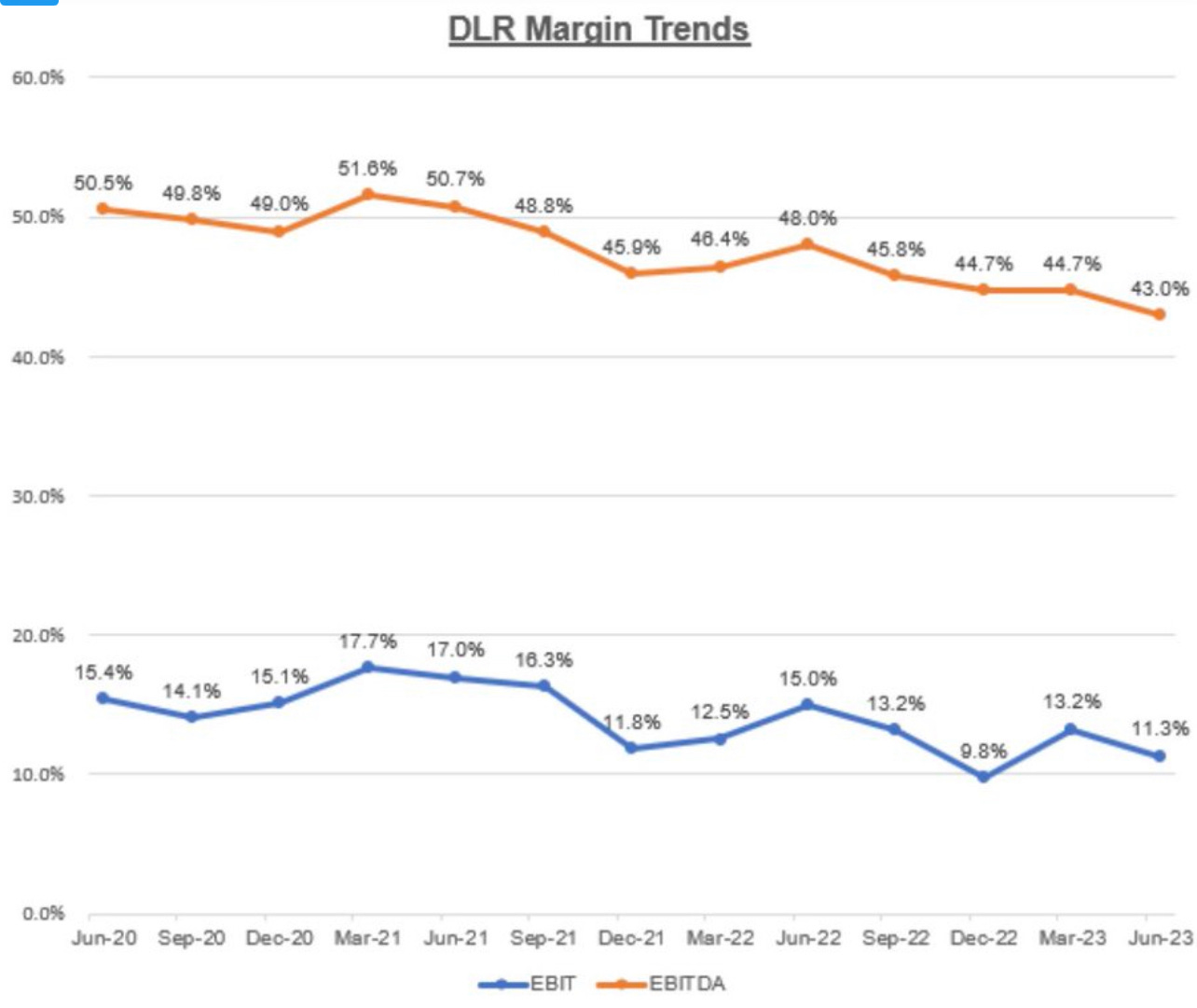

Back in 2016, the company’s largest client was IBM, which accounted for 7.8% of its recurring revenue. Last year, the largest client was Amazon and was 10% of its recurring revenue. As a data center REITs, the company has primarily two types of customers – the first type is the small-medium size companies’ co-location data center. Based on the definition in its 10K, it corresponds to 2–5-year contract, less or equal to 75 cabinets, 0-1 MW in power. Because of the lack of scale among its clients, DLR has stronger bargaining power and hence higher profitability. The second type of customers are hyper-scalers such as Azure, AWS, and GCP, to which DLR has minimal bargaining power. Since 2016, the EBIT margin and occupancy rate have both been declining because the small-medium size clients are migrating to the cloud, leading to less profitability at DLR going forward. To say it in a somewhat paradoxical way, DLR’s biggest enemy turns out to be the age of AI!

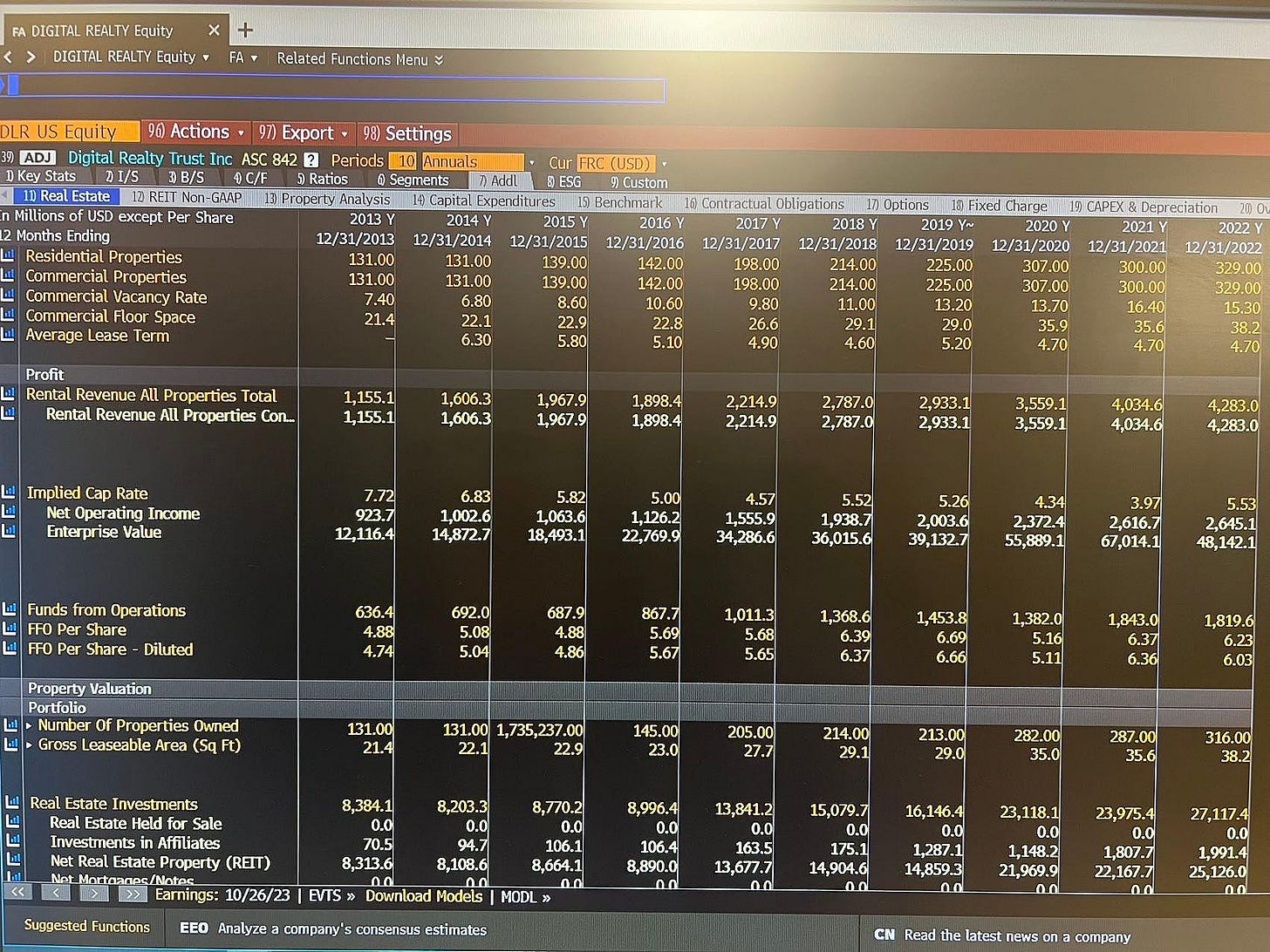

Figure 4: The commercial vacancy rate of DLR has doubled from 7.4% to 15.3% over the last year.

Figure 5: DLR has experienced consecutive profitability decline due to the rise of cloud and migration to hyperscalers, who have stronger bargaining power against DLR.

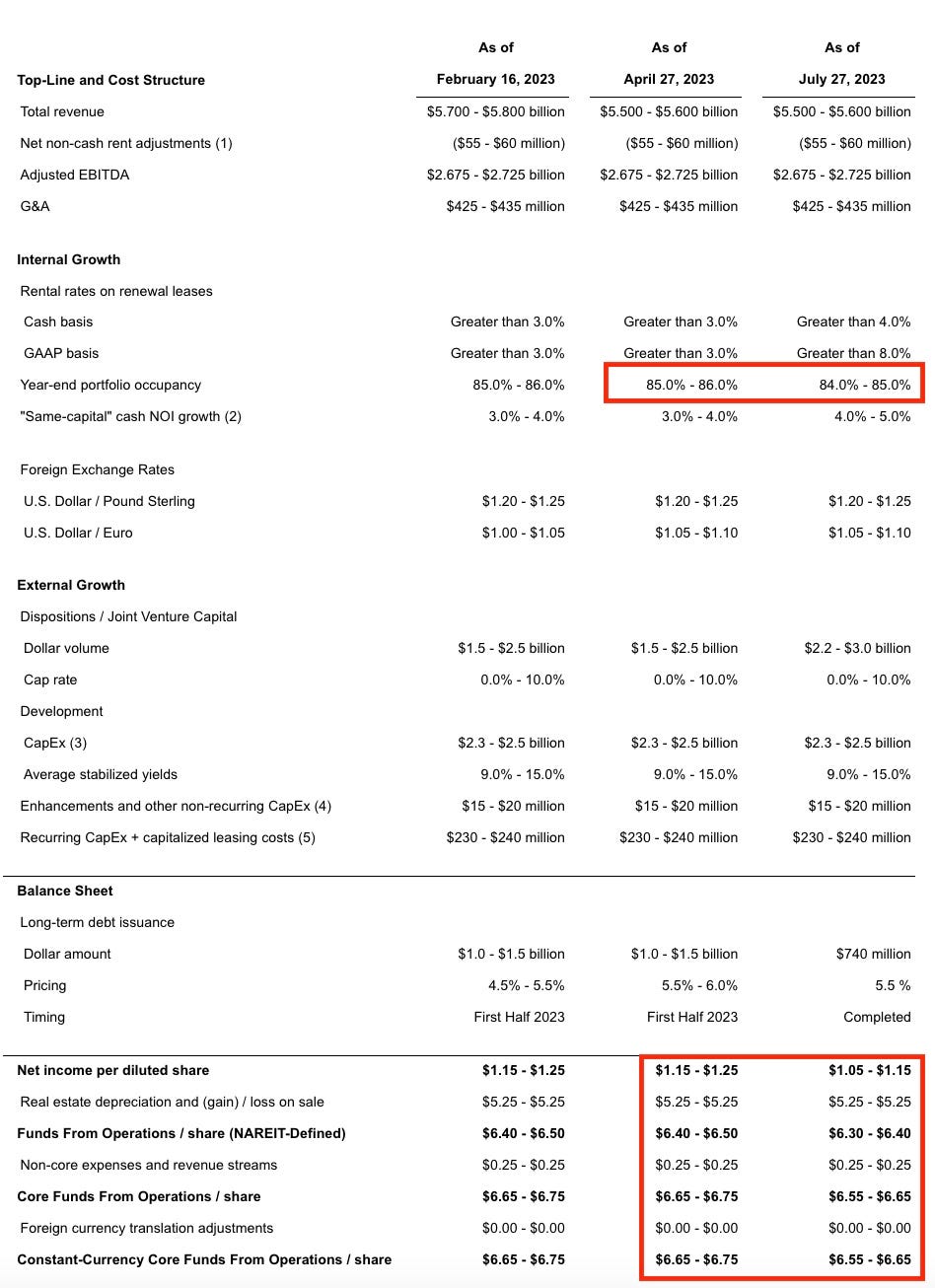

Figure 6: DLR has guided to lower net income per diluted share, lower FFO, and lower occupancy rate in Q2, and the subsequent stock price appreciation, in our view, is irrationally predicated on optimism on AI and data center, unjustified by fundamentals, thereby creating a great entry point for establishing a short position against it.

Digital Realty’s stock price advanced more than 50% from the recent trough due to the AI hype (for instance, Huang at NVIDIA said there would have to be substantially more investments made in the data center space), creating, in our view, a great short opportunity of a capital intensive, highly leveraged, low barrier-of-entry, and fake AI company. Our price target based on recent private market transaction is $70-80/share, with the stock presenting us with a 40%+ downside going forward.

Conclusion

Although we have delivered a sliver of outperformance this year against our benchmark, we believe our longs are substantially undervalued. In the world of value investing, we cannot expect ourselves to be heroes in fairytales, with our longs immediately appreciating and our shorts quickly declining — patience is oftentimes essential for long-term outperformance. We believe our portfolio will deliver satisfactory returns over time, and we genuinely thank you for being an invaluable partner in our investment journey/adventure.

Cheerios, to continued alpha!

*The performance record from April 2022 to August 2023 is the author’s performance at Atlas Capital of Boston, while the performance after August 2023 is the author’s performance at Dorfman Value Investments.