Q4 Investor Letter -- Bracing for the Worst

How We Plan to Navigate the Worst-Case Scenario in China

Dear Readers:

In the fourth quarter of 2023, we managed to churn out a 9.65% net return, while the S&P 500 delivered 11.67% return in one of the most magnificent short-term surges since 1982. This brings our full-year net return to 23.8%, while the S&P 500 return for the whole year is 26.3%. Our net return is calculated as the time-weighted average return (TWR) adjusted for account size weighting. If you joined us before Q3 2023 and has not received a hardcopy of your mailed individual report (especially if you reside outside of the US), please kindly let us know, as it is mandated by our regulators that we shall mail you the returns & reports — electronic communications (such as using Substack alone) does not fulfill regulatory requirements.

For the whole year, we trailed the S&P 500 by 500 bps. Our shorts moved substantially against us — the companies in the US with the most dubious fundamentals and some which we believe are simply “terminal shorts” (or, put in another way, “zeros” in a bear market/economic downturn) delivered some of the most outstanding price appreciation this year. We continue to short some of the most egregious offenders — “in the short term, the market is a voting machine; in the long run, it is ultimately a weighing machine.”

Given most of our portfolio holdings are in China and given this year is one of the most vicious bear markets in China across major indices, you can safely assume your portfolio manager lost a fair number of nights of sleeps. Hang Seng index declined by another 4.3% in Q4, in sharp contrast to S&P500. It successfully completed its longest losing streak in the history of its existence, and individual equities were collapsing left and right, destroying our peers one after another. While we have been able to pick out some of the real outperformers, such as PICC Property & Casualty discussed in our first quarterly letter, WH Group discussed in our second quarterly letter, and CSPC Pharmaceutical discussed in our third quarterly letter, we find it tremendously difficult to completely defy gravity. If major Chinese indices continue to collapse into 2024 and the US market maintains its seemingly perpetual bullishness, you may safely assume that we will underperform again in 2024. Obviously, we do not buy into that scenario.

Figure 1: 2023 Major Index Return (excluding dividend). Adding insult to injury, the Russia equity index outperformed Hang Seng index by a staggering 27.8%.

Is China Toxic?

At present, U.S. investors shy away from Chinese assets as if these are the most toxic assets on a global basis. A renowned investor whom we look up to told us directly that investing in China is “gambling”. We understand institutional constraints, and to guard themselves against tail risk, they rightfully refrain from investing in a place where “rule of law” is not a thing. It is both rational and understandable. However, we simply disagree that all Chinese businesses are uninvestable. Chinese entrepreneurs are diligent, intelligent, while Chinese people work much longer hours and have a desire for wealth that does not find peers on a global basis.

We have been in the minority almost every time we make a concentrated bet. When your portfolio manager was an individual investor and surveying the oil & gas landscape, there were few analysts left on the street in this sector, and one Morgan Stanley report on the space would have 17 (!) factual errors. When your portfolio manger was buying regional banks earlier this year, banks were the least held asset among hedge fund managers. As a matter of fact, we welcome foreigners to sell as many Chinese assets as they want. Remember when they were forced to unload CNOOC (NYSE: CEO; HK: 0883) back in Jan 2021 due to the blacklist? Oh boy, we bought as much as we could when the foreigners were forced to sell, and we made our original investment back through harvesting dividends in three years; meanwhile, our principle doubled due to price appreciation — we love chips with blood, we truly do.

The Misleading Example of Alibaba

Figure 2: Alibaba’s equity price performance over the last decade.

One common theme we heard from foreigners is: “Chinese stocks are bad investments. Look at Alibaba”. It is true that optically, simply assessing stock price performance, Alibaba may have been a proverbial “dog”. Since its IPO, it” has delivered an absolutely abysmal return of -17.49% in the last decade. It is a far cry, however, from being able to ascertain Alibaba as an unsuccessful business, at least not for a good part of the last decade.

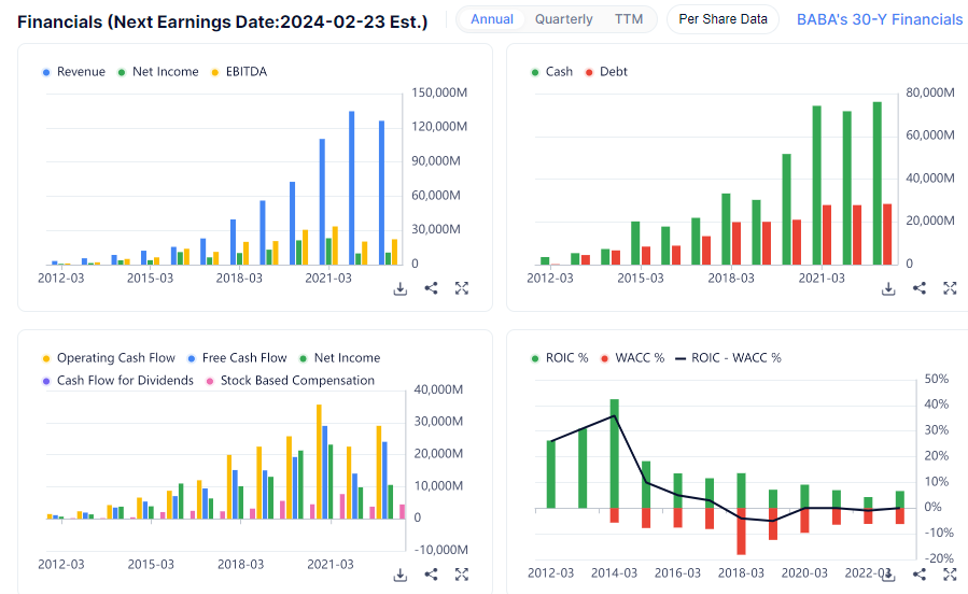

Since 2014, Alibaba has grown its revenue 15x, and its free cash flow 7x. How many US companies have been able to achieve that?

Figure 3: Alibaba’s growth and profitability metrics.

Yes, Alibaba has a lot of issues. It had a Chairman that epitomizes a “loose cannon”, a destabilizing factor in a new, autocratic political regime; it has grown into an unwieldly bureaucracy that is inefficient and inflexible; it failed to recognize Pinduoduo’s potential in its early days; when it was sitting on its laurel, it was probably one of the worst capital allocators in modern corporate history, throwing cash after a large collection of low-return-on-invested-capital “garbage” that ultimately resulted in substantial deterioration in overall corporate profitability and return on capital; last but not least, due to political issues (and idiosyncratic incentive structure issues), Ali-cloud, supposedly its next growth engine, utterly lost steam, and the planned spin-off was called off as well.

However, in our view, all of the above are secondary.

Figure 4: Alibaba’s historical price to sales multiple.

If you pay a 22x price to sales for any security, you’d better be really sure of its growth potential. Otherwise, you’re going to lose your shirt. When Buffett bought Apple Inc, he paid for 8x price to earnings on a net market cap basis. Everyone’d like to think herself as a Masayoshi Son, but come’ on, even the one and only Masa has lost his shirt over the last two years!

A number of our peers who made their money (and name) through overseas investments in US listed Chinese ADRs have paid an expensive price (with their clients’ money) in the last several years during the sea change that has been characterized by a generational multiple contraction. We are, however, just warming up to the multiples in the last two years. When we bought Pinduoduo (a major contributor to our performance last year and earlier this year), it was a 40%+ GMV (gross merchandise volume) grower valued at 5x run-rate free cashflow with Temu as an embedded option that was not been priced in at all — it’s hard not to make money under such scenarios. We do not have to swing at every opportunity. As long-term, event/cycle-driven investors, we can afford to be patient and wait for the fat pitches.

As we have, hopefully, as clearly articulated as possible through examples in Puerto Rico and Iran in our 4Q 2022 letter, it is not the country that matters — it is the assets.

China’s Challenges

Despite everything said above, we acknowledge the unprecedented challenges China currently face. China has been an economic miracle, a monstrous growth engine that barely knows what an economic slowdown is. Yet now it faces deflation. Its producer price index has been contracting year-over-year for 14 months now, and its consumer price index contracted 50 basis points last month, unmistakably pointing to a country with flagging demand and lackluster growth prospects.

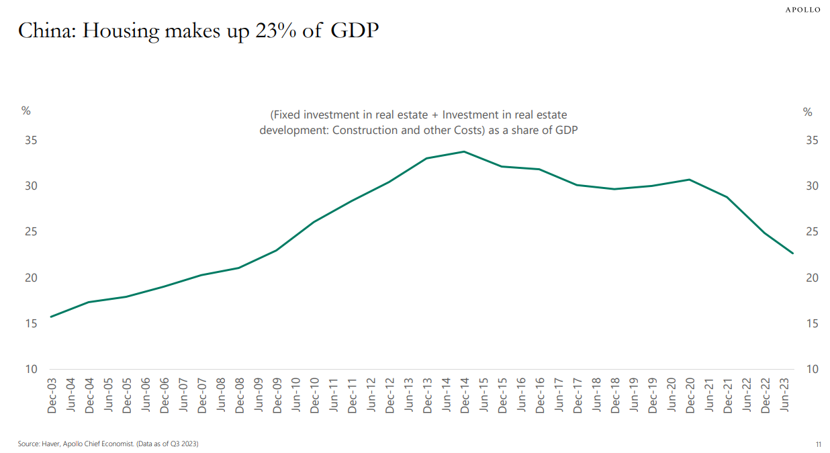

Figure 5: China’s housing sector as a % of overall GDP.

Housing is still 23% of Chinese GDP, 8 percentage points higher than the peak of housing as a percentage of GDP in the US right before the Great Financial Crisis.

Figure 6: China real estate index since 2016.

With declining housing prices comes a clear suppression of consumption desire. Households, local governments, and corporations, laden with debt, need to repair their balance sheet. The CPI decline is but a reflection of the fact that China may have already entered what Ricard Koo calls a “Balance Sheet Recession”.

Figure 7: Chinese rural and urban population growth.

To make matters worse, population growth has been declining as well.

Figure 8: China’s dependency ratio.

Old age population as % of working-age population is just about to enter a reflection phase to skyrocket higher. Back in 2000, there were 10 workers for each retiree, fast forward to 2023, that number is halved.

We all know that GDP is largely constituted by export, investment, and consumption. The marginal return on further investment is pathetic in every way — what Jim Chanos calls a “Treadmill to Hell” has to come to a screeching halt; trade wars and ideological conflicts certainly do not help export; consumption itself is troubled by demographical and balance sheet issues delineated above. It is worrisome that the government, having purged itself of economic technocrats, simply cannot find a direction going forward, still trying to stimulate incrementally lower return manufacturing sector to boost GDP growth, failing to appreciate the significant impediment that’s faced by the consumer sector.

We can only stay vigilant and be salient of such realities. We have to adapt, to come up with a strategic playbook to navigate the macro-uncertainties, wade through the economic downturn, and hopefully firmly grasp the precious shares of companies that will emerge in a stronger position.

Our Playbook

We want to delineate a clear framework on which we make our equity selection decisions. Here we go:

First and foremost, we ensure our portfolio holdings have low leverage. Except for some whose business models have leverage intrinsically built in, our overall equity selection has been upgraded in Q4 to further lower the debt component. Most of our holdings have a large cash hoard on their balance sheet, or their net debt/EBITDA is below 1x. We know that debt overhang and deleveraging are painful processes, so we take the initiative to select corporations that have the ability to fight back and/or expand in the downturn and can act as contrarian players to snatch up undervalued assets at the bottom.

Secondly, we have been gradually increasing the cyclicality of our portfolios. We are expanding our exposure to infrastructure, consumer, and pharmaceutical related stocks that may be experiencing temporary pains. The down cycle will eventually pass, and excellent companies will eventually reclaim their glory. This allocation logic itself reflects our gradually increasing risk exposure — we believe that by taking risks wisely during the down cycle, we can enhance our cross-cycle return.

China is experiencing bona fide resonating cycles — global capital flight, domestic balance sheet repair, and various industrial cycles. These resonating cycles reverberating with each other, creating one of the better long-term investment opportunities going forward.

Table 1: Types of cycles and their corresponding granularity.

We have, in much detail, shared our approach in an interview this year. China is experiencing bona fide resonating cycles — global capital flight (exacerbated by sentiment cycle and liquidity drain), domestic balance sheet repair, and various industrial cycles. These resonating cycles reverberating with each other, creating one of the better long-term investment opportunities going forward.

Thirdly, in a down cycle, profitability is compressed, weak players weeded out, growth compressed. However, we take advantage of our longer duration to endure short-term fluctuations in exchange for longer-term gains. We make sure our holdings have longer-term secular growth prospect or are the lowest cost player likely to gain substantial shares.

Finally, in the selection process, we look for outstanding entrepreneurs who also have a good history of shareholder returns. We like to see management actively increasing holdings, has a large ownership, have a high dividend payout, and/or be willing to repurchase shares. No matter how good the assets are, if there is no shareholder friendliness for capital returns, it will eventually end up being “seeking skins from a tiger”.

Epilogue

We believe that hard-working and intelligent Chinese entrepreneurs can find a way out, whether it is differentiated competition, niche penetration, or overseas expansion. The Yellow River has nine twists and turns and will eventually merge into the sea. We’d like to be part of this historical process of monumental grandeur, and through investing our capital, support the transition.

*The performance record from April 2022 to August 2023 is the author’s performance at Atlas Capital of Boston, while the performance after August 2023 is the author’s performance at Dorfman Value Investments.

Hello Black Bread I come from Xueqiu, want to know any update comment on First tractor?

Great article, inspiring perspectives. I have also asked myself the question, China is experiencing numerous issues (i.e. worsening business environment, to a certain extent dysfunctional government, declining marginal return on investment, painful deleveraging, rapidly aging population and low birth rate), and some of the issues are structural, should I continue to focus on Chinese assets and devote research time into them? I have answered the question with "YES", mainly for 1 reasons: macro environment is only one aspect, what's more crucial is the quality and valuation of each individual assets. I do see more and more best quality Chinese assets selling at reasonable prices (sometimes even unreasonably low prices), whereas US quality assets are quite expensive and I don't think it's sustainable. It may be a long winter for Chinese assets in general, but I believe holding best quality low priced Chinese assets will offer good and sustainable long term return. :)