In Q4 2023, we are finally warming up to Meituan’s valuation. Despite its incessant decline in equity price recently, we have been gradually adding our exposure to make it one of our largest holdings.

Back in 2022, Meituan was valued at a considerable premium vs. PDD, and we voted with our feet and bought PDD. The market believed Meituan should enjoy a higher multiple because it has a near-monopoly status in take-out delivery, whereas PDD will have to fight within a difficult market environment to compete with a myriad of e-commerce players such as Alibaba and JD.com. However, what the market failed to see was Meituan’s most profitable segment, in-store (到店), was facing severe encroachment by Tik Tok, while PDD’s cross-border ecommerce platform, Temu, was just about to take off. In addition, through relentless execution, with a most efficient corporate army that we have ever seen, PDD was also beating the pants off of Alibaba and JD.com.

After Meituan lost 67% of market price and PDD gained 200%, the risk-reward is quietly shifting.

Below are our (much abbreviated) theses:

Firstly, we are aware of some of the sellers (and why they sell). Three years ago, a bunch of public funds in China piled into the high-flyers of the last bull market, and Meituan, reaching a peak market price of more than 460 HKD per share back on Feb 12th, 2021, was one of the hottest shots among public equity investors. These funds currently face redemption pressure, and to window dress their portfolio, they tend to preserve their resilient picks such as spirits holdings, and to sell the “dogs”, such as Meituan. The selling which is little based on fundamentals led to even more selling among retail investors who tend to follow the herd, resulting in a downward spiral extremely similar to what we have observed back in March 2022. We like chips sold for liquidity concerns — we thrive on providing liquidity under share price collapsing scenarios.

Meituan’s revenue come from three sources: 1). food deliveries; 2). in-store, hotel & travel; 3). new initiatives & others. Its most profitable segment is in-store, hotel & travel, while new initiatives & others (such as Meituan Select, Meituan Grocery) are money losers. It enjoys a virtual monopoly in the food deliveries segment through a triple-sided network effect (customers, merchants, and riders) — typically, the more sides of networks you have, the stronger is the moat, and most of its tech peers in China enjoy only two sides of network effect.

The market has two worries, reflected in its depressed equity price, which we will address in the second and third points of our theses.

Market’s first point of concern has to do with Meituan’s in-store segment being under attack from Tik Tok. People tend to be fearful of they do not know, and Tik Tok, because of its private status, has frequently been depicted as an invincible player that excels on everything. This over-exaggeration of Tik Tok’s omnipotence has been played out once back in late 2022 when Meta was sold off (among many other reasons) and since then Meta has completed a journey of quadrupling its share price. Tik Tok was buying back shares in 2022 at a valuation of $300 billion, and its most recent buyback in December 2023 values the business at $268 billion — and this is on top of an operating profit of 6 billion. It has the most outlandish valuation among all US listed Chinese ADRs that we follow, yet it has not been immune to the relentless punishment of multiple contraction in the last year. It is true that Tik Tok has been making big progress on in-store, but it has not gained market share against Meituan due to Meituan’s effective countermoves. As a matter of fact, Tik Tok may have helped Meituan to come alive to the challenge and grew their GTV (gross transaction volume) by 90%+ YoY to more than 700 billion RMB on a run-rate basis. Next year, it has a chance to break the trillion RMB GTV threshold. It has defended its market share very well, which, in our view, is perhaps one of the more important metrics for assessing a tech business. The bear would argue that the market share stability came at a hefty price of significantly compressed margin — well, Tik Tok does not pay a cheaper price.

As a matter of fact, Tik Tok’s in-store operating margin has been pushed into negative territory. If Meituan is able to maintain its profit margin and market share, then Tik Tok is actually in a terrible position — it is not gaining market share, and it is losing money. At a certain point, Tik Tok will have to rethink about its optimal strategy, especially if it intends to go public in the near future.

Chuan Zhang (张川)’s recent internal letter indicates Tik Tok has an edge in 4th and 5th tier cities. This is not surprising given it’s a streaming platform and naturally enjoys an outreach advantage compared to Meituan’s delegated model in those cities. However, Meituan has realized this, and is taking effective measures to counterattack. Although Tik Tok is the most powerful streaming platform in China, let’s not forget it’s facing serious challenge from WeChat Channel, which is precisely how Meituan is structuring its counterattack around. In the world of technology, high frequency wins, and no app enjoys a higher user engagement and interaction frequency than WeChat.

Along with the WeChat Channel, Meituan is organizing its troops to penetrate the lower tier cities, and it has the margin structure that can support lower price, which, in our view, is the ultimate driver for long-term customer engagement, especially in the lower tier cities. Last but not least, we’d like to point out that in-store service sales for the prominent brands may be easier to be represented and/or advertised on Tik Tok, but the smaller mom-and-pop’s are not necessarily the most suited candidates. In sum, we believe a lot of the fear driven by Tik Tok is unwarranted. As Chuan pointed out, Tik Tok is a “rational” opponent (unlike the other thousand deliveries companies that went out of business years ago during Meituan’s uprise), and just like it exited food deliveries after abysmal results, it will reevaluate its going forward and coexistence strategy with Meituan — for an oligopoly market, the players typically sort it out.

Market’s second point of concern is potentially more problematic for the bulls — in theory, Meituan can keep burning a boatload of cash for New Initiatives which can in principle be paid back to shareholders. However, this is precisely why we are bullish on Meituan.

It is of our habit to think of the negative when things are good, and to think of the positive when things are bad. We are contrarians, we will always be.

Meituan fits a pattern where a fantastic business segment is masked by a shitty business segment, and when the shitty business segment is turned around, the stock will surge. We have seen this played out in numerous US listed equities ranging from ON Semiconductor in 2014 to Primerica in 2022.

Let’s first get one thing clear — valued by the Core Local Commerce group, Meituan is cheap like dirt.

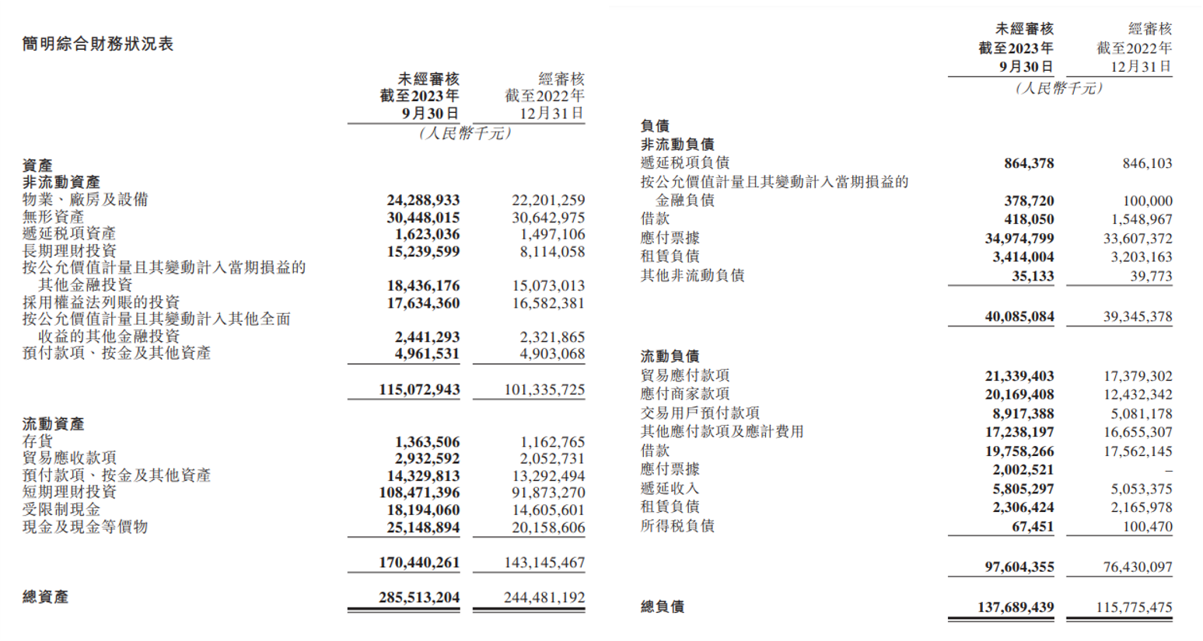

Meituan has a total debt of 20.1 billion RMB. It has cash and equivalents of 25.1 billion, long-term wealth management of 15 billion, and short-term wealth management of 108.4 billion. In other words, it has a net cash position of 128.4 billion RMB. Translated into HKD, that’s 140 billion HKD. As of yesterday’s close, the stock has a market cap of 440 billion HKD. So, the company has a net market cap of 300 billion HKD.

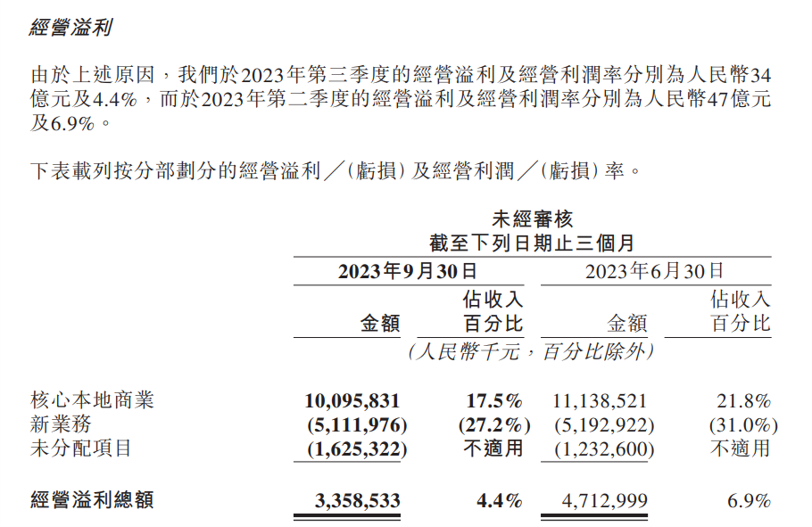

The Core Local Commerce has an annual run-rate operating profit of about 44 billion RMB, or 48 billion HKD, which is likely to grow at double digit for the foreseeable future. Assuming a tax rate of 25% (average Chinese corporate tax rate), that’s 36 billion HKD of net profit.

To put it in simple terms, assuming New Initiatives is worth zero, Meituan is trading at 8.3x net market cap to net profit, and is growing at double digit. To us, this is nuts.

Again, it is sort of like a deja vu from Meta’s 2022 — Mark insisted on throwing a massive amount of cash after Reality Labs, pissing the Wall Street just as its ad revenue was growing the slowest since its IPO, pummeling the stock price to the 80’s, before he reversed course and started firing employees and buying back stocks. Meituan is doing the exact same. We have heard Meituan is embarking on laying off some workers to optimize corporate efficiency, and in Q3’s earnings call, they expressed a willingness to start buying back some stocks. Although they have not bought back any in the public market yet, we believe they’re going in the right direction. They have gone through the “thousand deliveries warfare”, and understands the significance of having cash on hand during critical joints (remember when Wang posted his bank account in a public presentation to assuage fears of liquidity crisis? like us, this management team clearly understands that liquidity is never there when you most need it, and they want to hold their destiny in their own hands) Lastly, different from a SOE (state-owned enterprise) whose managers are rubber-stamps and can’t care less about the shareholders, the Chairman of Meituan, Xing Wang, owns 8.3% of the stock and that constitutes most of his net worth. Based on what we have learned through following him for years, we believe Meituan will ultimately make the rational decision to maximize long term shareholder value.

Risks:

While we are supportive of Meituan through owning its shares as one of our major holdings, we are ready to admit we are wrong and move along if the facts change in a way that destroy our theses.

If Meituan continues to burn an exorbitant amount of cash through New Initiative without any prospect of generating a satisfactory ROI;

If Meituan engages in value-destructive acquisitions in East Asia;

If Meituan’s in-store business deteriorates substantially and it starts to lose market share in a meaningful fashion.

Disclosure: We are shareholders of Meituan and do not have intention to sell within the next 72 hours. We do not hold Meituan for one of our investors whose significant other is a Meituan employee. None of the above should be construed as investment advice, and we may sell our holdings without a heads-up. So please do your own research and come to your own conclusion.

Thanks for timely sharing!

I am a potential LP, how can we get in touch?