Since the inception of the fund on April 19th, 2022 till December 31st, 2022, we have generated a net return of 14.32% after fees, expenses, and carry. In the interim, the S&P 500, our benchmark, declined by 12.54%. We outpaced our S&P 500 by 26.86%. Due to incrementally more price dislocation, we have started to build our concentration.

2022 has been a very tough year to navigate. It is a year filled with “black swans” – a hot war on the European continent, an economy with unprecedented inflation rate, a particularly hawkish Federal Reserve, and a third turn of a Chinese president with essentially no check-and-balance.

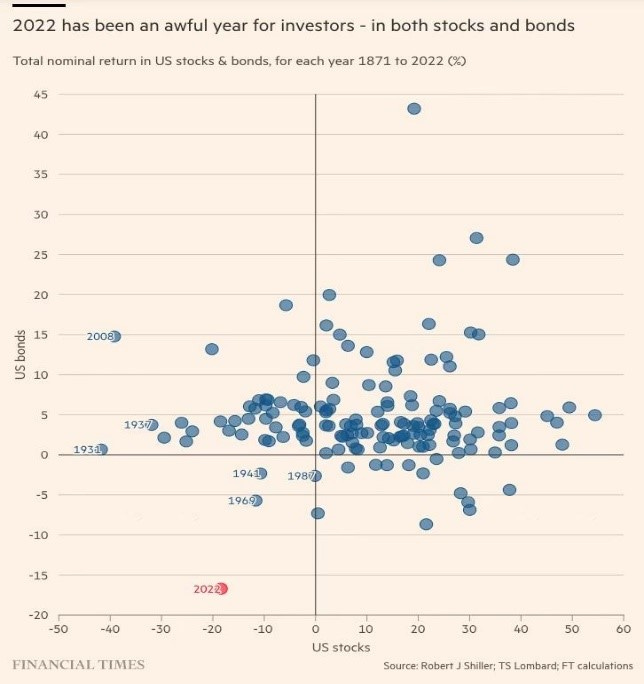

To put things into perspective, when we take a holistic view on stocks and bonds, it is the single worst year of combined performance since 1871.

However, I am not here to whine about the difficulties of making money under such a market condition – I am here to share with you an interesting phenomenon regarding equity performances regardless of countries and markets.

The “Independent Life” of Equity Performance

Through analyzing multiple markets across the globe, I have found that equity prices can assume a price trajectory completely detached with the underlying economy – equity prices are like springs, when they are compressed to the extreme, they bounce back in a violent fashion no matter what happens to the economy.

Let me illustrate this point with an example.

Above is the GDP per Capita for Iran denominated in US dollars. As one can observe, one of the most salient features of the time series is that the Iranian Rial has declined by 70% of its value in terms of GDP per Capita. In other words, the incrementally more stringent economic sanctions imposed on this hapless country has led to absolutely horrendous personal living standards of the citizens of this country.

One might naturally deduce that the Iranian market will respond to the dire economic reality of the country, and assume a similarly downward trajectory.

Nothing could be further from the truth.

As one can see from the above, TEDPIX, the stock market index of Iran, has gone up more than 10-fold since 2016. Even if we adjust for the 30% currency depreciation against dollar since 2016, we arrive at a close-to-ten-fold appreciation. In other words, you get a ten-bagger simply by investing in the Iranian market index -- a country fraught with social unrest, authoritarianism, western sanction, oil price collapse from 2018 to 2020, and constant riots at its capital.

As a matter of fact, the western sanction which sounds so dire and punishing did wonder to some of its domestic businesses.

For instance, Gorji Buscuits is a Tehran based company that operates in the cookie, cracker, and pasta manufacturing sector. With the sanction in place, lots of chocolate and cookie companies with international roots had to retreat from Iranian soil – but will the Iranians quench their desire of eating yummy cookies and chocolate? No way! Naturally, the net sale of the business quintupled from 2019 to 2022.

Similar “replacement logic” exists for other businesses. Will Iranians stop washing hands and cleaning faces just because foreign manufacturers of such products exited the market?

Even currency depreciation turned out to be music-in-the-ears for export businesses such as urea and glass manufacturers. When asset prices are low enough because of foreign capital retreat and fundamental feelings of detests, they find bottom at a certain moment in time, and came back up with vengeance.

We all know Iran is a huge exporter of oil – if I told you in 2016 that it would be sanctioned and global oil price will utterly collapse in 2020 leading to the worst bear markets for energy in two centuries, will you even think about dolling out a dime for this God-forsaken market?

I hope your answer at this point will be – it depends on the price.

The Tale of Three Banks

If you have an inquisitive mind and is not satisfied with a case study of one particular market, lets explore another one – the market of Puerto Rico.

Between 2007 and 2017, Puerto Rico’s GDP declined by 14%. In 2015, 46% of its population lived below the federal poverty line, vs. the US national average of 15%. Puerto Rican national debt stood at $74 billion, and unlike US mainland municipalities, it’s not protected by Chapter 9 of the US Bankruptcy Code and could not file for bankruptcy. On June 28, 2015, Governor Garcia Padilla admitted publicly that “the debt is not payable” and that if the government was unable to the grow the economy, “we will be in a death spiral”. Before Padilla’s admission, various government instruments had already entered into forbearance agreements with their lenders, but the warning still provoked a drop in Puerto Rican bonds and stocks. To make things more exciting, the committee formed to supervise Puerto Rico’s debt restructuring was constituted by a group of lenders who turned out to be vulture hedge funds circling Puerto Rico trying to squeeze out a profit. With a population of 3.12 million, $74 billion debt translates to $22K worth of debt per capita. Oh, and by the way, the population of Puerto Rico was 3.99 million back in 1999, and it has been all the way to the south without a lookback.

Let me pose this question to you: Are you willing to invest your money in Puerto Rican banks for the past five years?

I hope your answer is: Well, why don’t you let me know their prices!

To spare you with the suspense, First Bancorp (the largest publicly traded bank) in PR returned 135.56% and OFG Bancorp (the third largest publicly traded bank) returned 197.95% in the last five years, while XLF (the financial service sector index returned 20.38% and S&P 500 returned 39.97%. By the way, the worst performer among the three remaining banks on the island, namely Banco Popular, returned 83% over the last five years. In other words, Puerto Rican banks kicked lots of asses.

Macro stories are oftentimes spectacularly fascinating, but investing is a lot more nuanced than absorbing macro narration.

Why was OFG Bancorp such an outperformer?

Firstly, despite scary macro headlines, the company is very “safe”. The capital level back in 2017 was higher than 11%, much more above the industrial average back then of ~9%.

Secondly, the banking industry was consolidating. Back in 2008 there were 11 banks on the island, in 2017 there were six, and presently there are only three major players. A smaller number of players led to rational competitive behavior, and the largest player First Bancorp stopped competing for deposits by hiking deposit interest rates, leading to a NIM (net interest margin) above 4% back in 2017 compared to the 3.1% industrial average.

Thirdly, OFG has been solidly profitable, sporting a ROA (return on assets) of over 0.9% since the second quarter of 2016.

Fourthly, despite the risk of government debt restructuring, OFG simply did not own any of the PR government publicly traded bonds. The only credit risk OFG has to PR government debt were loans to a few of the larger local governments which were not subject to debt restructuring and also backed by property taxes.

Last but not least – it was dirt cheap!!

How to Apply the Learning – and How I Screwed Up

Most of our outperformance this year related in one way or another to the concepts delineated above, namely – forget about the macro narrative, focus on the micro-opportunities, find detested assets, and pounce with conviction and audacity.

I devote this part of the letter to examine an opportunity that has NOT been well-seized during the last quarter of 2022. If I had a deeper understanding of the veracity of my own theory, we could have achieved an investment return north of 50%. There is no medicine that cures regrets, but active learning will hopefully allow us to seize such opportunities when they are presented to us again in the future.

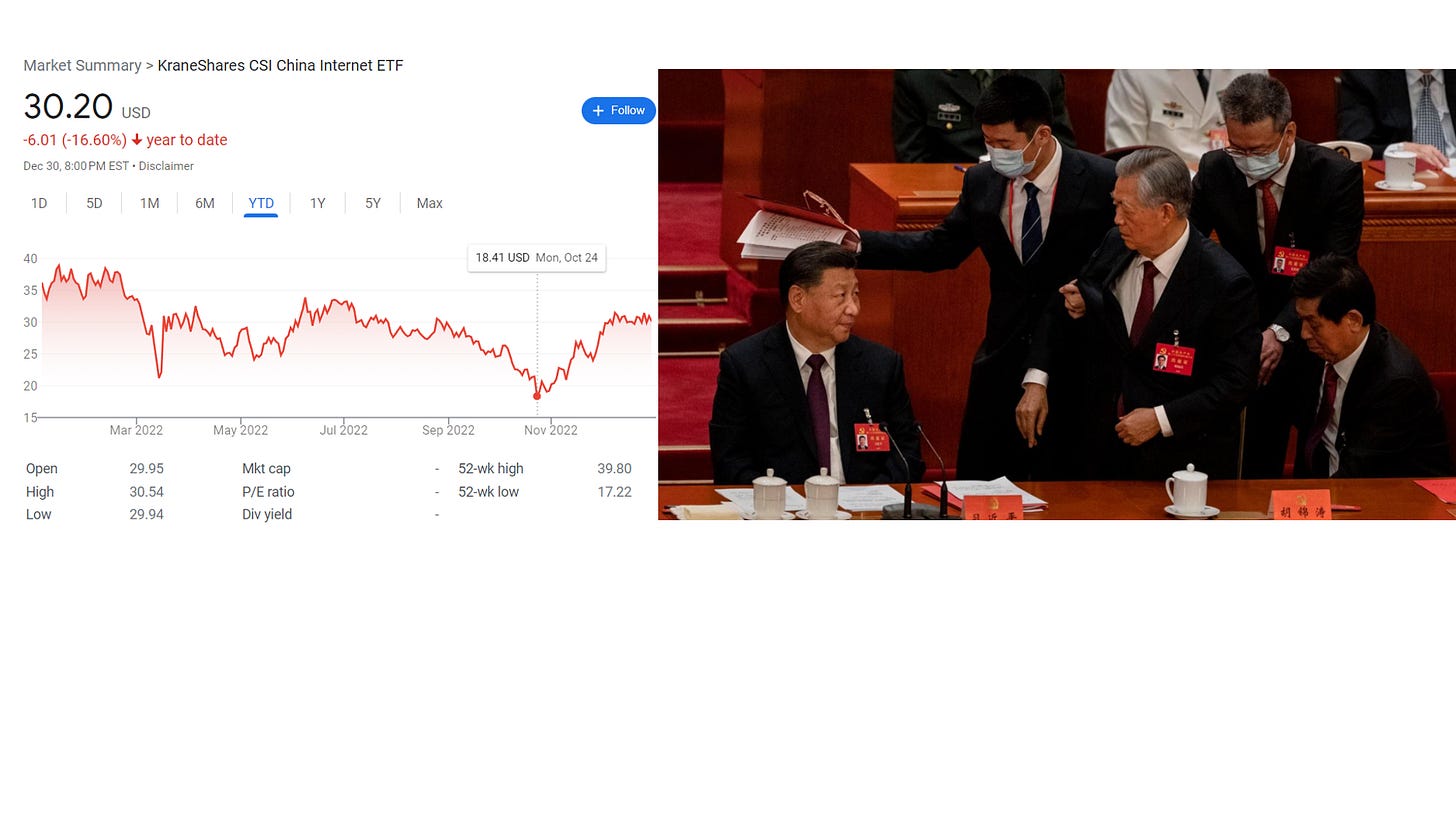

By the end of the 20th Congress, Jintao Hu, the previous president of China, was essentially “hijacked” out of the final meeting where the names of the next class of leaders were to be announced. In addition, Xi has completely destroyed the legacy of previous leaders by installing his people across the board, wiping out the reformists in one swoop, destroying whatever check-and-balance that was left in the country. The capital market responded with vehemence, with the Hang Seng index in Hongkong dropping to its 1997 level, erasing China’s 25 years of unprecedented growth. KWEB, which is the index that trades in the US and tracks some of the technological leaders in China, completely cratered.

That night, when I opened my app and saw Tencent and Alibaba each losing close to 10% of their market caps, I lost emotional control. In the social app WeChat, I told my limited partners that we would sell out of our Chinese holdings, and vote with our feet by refusing to endorse such a monstrously authoritarian regime. I was depressed for a whole month and was sick for more than two months – I felt China would be a motherland that I could never return to. It was the first time ever in my life that I tasted the bitter fruit of despair.

As these Chinese ADRs were hammered, I managed to largely stay rational by not reducing our net exposure, but I failed to seize the opportunity to employ what we have discussed in our last letter – to take advantage of forced selling & liquidity crunch and concentrate our bets. A social app with stable MAU (monthly active users) was selling at $4.5/share with $7/share of net cash on its balance sheet, north of 10% of dividend, and 60 cents/share of earnings; another ecommerce company was selling at $40 billion market cap with billions of dollars of net cash, generating a $4 billion profit this year, and growing at north of 60% year over year. These stocks should be cinches for me, and I should have loaded up on them when my counterparties were liquidated, but I simply lost courage to act in the face of the political turmoil and grim outlook of China, allowing my emotion to overwhelm my sense of rationality, and letting go of a golden opportunity of more than doubling our investments in 2 months.

It turns out that when it is your own country that is getting sold due to legitimate concerns over its growth prospects, it is orders of magnitude more difficult to take contrarian actions.

Hopefully I learned something.

Outlook

2023 will probably be another hard year to navigate, given that private savings have greatly diminished, Fed has been consistently hawkish, the trailing earnings of S&P 500 is $200/share implying a 19x PE ratio for the index (which is high under a recessionary scenario), and the Buffett Indicator (equity market cap vs. GDP) is still substantially above its historical average.

Druckenmiller could be right that the index stays flat for the next decade, but pockets of opportunity will always exist for the market for the intelligent investors to exploit.

In the world of capitalism, the sun is always rising somewhere, it always does.

Sincerely,

Jingshu Zhang

Dec 31st, 2022

Could you share some insights on choosing IBM as top short selling?