Performance Update

Feeling like a scratch on a new car, Q4 2024 marks the first quarterly decline since I started managing third-party money back in early 2022. In Q4 2024, S&P 500 gained 2.41%, while our portfolios declined by 6.37%. For 2024, we delivered a net return of 13.24% (16.76% in RMB terms) after all transaction costs and fees, while S&P 500 has advanced by 25.02%, dividend included. Since, inception, we delivered a compounded annual gain of 19.08%, while S&P 500’s annual gain was 12.69% during the same period.

In the last twelve months, I have made a number of judgment errors, especially on some of our highest conviction bets. The market has moved up substantially more than my original expectation, while several of our highly weighted longs have gone the wrong direction. I hope to take a moment to reflect on these mistakes and share them candidly with you.

Misjudgment on Macro

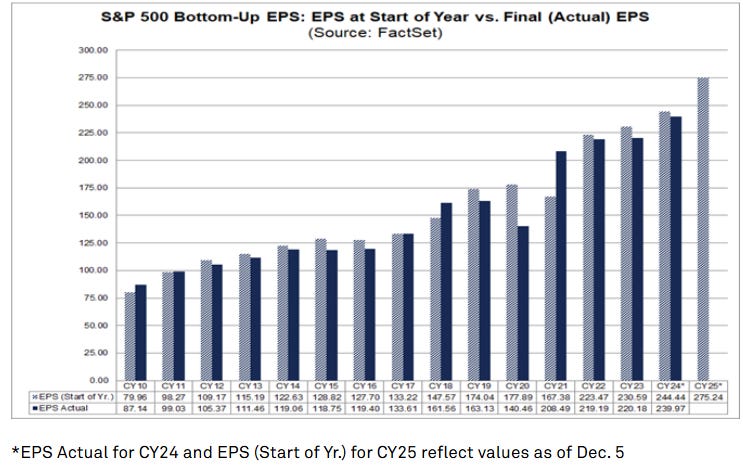

At the beginning of the year, I thought S&P 500 trading at 19.4x forward earnings was not a bargain, and we took a defensive stance from the get-go. I further considered the market’s optimistic view on the number of rate-cuts to be unrealistic, and that prediction turned out to be correct. Ultimately, S&P 500’s actual EPS advanced 8.9% for 2024, and the index marched 25.02% higher. The consensus penned in a 14.7% EPS growth for 2025 off of a high-base set in 2024, which, in my view could be too optimistic. The forward PE for S&P 500 is now 21.7x, more than 2 turns higher than a year ago. The optimistic view on EPS growth in 2025 is contingent on major breakthrough on AI, and should AI disappoint, the reversal of a capital expenditure cycle of the mega-caps in response could lead to a cascade effect, implying considerable downside risk of the EPS estimate.

I hesitate to call my defensive stance a “mistake”, because historically market just doesn’t deliver 15% of annualized return on a consistent basis. I acknowledge the quality of some market leaders that can move the needle, but I believe investing in high-single-digit grower Costco at 60x earnings or no-growth Apple at 40x earnings will not fare well for their investors, while bag-holders of hopes-and-dreams stocks like Tesla, or semi-Ponzi schemes such as Digital Realty and Microstrategy will turn out to be unmitigated disasters. The timing of such unavoidable events is difficult, but the writings are probably already on the wall.

I’d also like to provide you with some historical perspective. In early 1928, the Dow Jones was trading at 191, and by Oct 1929, it traded up to 381.2, a quick and nice double in a bit more than a year.

55 years passed, Dow Jones advanced 189%. This is a 1.95% annualized return excluding dividend. Of course, the ones who are flying high are not going to listen to my cautionary tale, simply brushing it aside, “time is different, now we have artificial intelligence, cloud, and so on. We are going to Mars, and cars are gonna drive themselves”.

I apologize, but I am not a venture capitalist and I do not have unbridled optimism for humanity. I look at numbers, facts, and use my logical deduction within my circle of competence to arrive at sensible valuation of selected businesses. I shall allow Sir John to speak:

In sum, I believe as long as you trust my judgment, I will refuse to participate in momentum investing or speculation, and I will continue to follow the first-principle of valuation and evaluate businesses on the cashflow they will generate over time and discount them to the present, even though I may be sidelined for long periods of time. To me, the prudent preservation of capital is a lot more important than investing in things completely speculative or non-analyzable to chase short-term gains. I have to be honest with myself and confide in you an unavoidable reality of my personality — I just hate speculation, momentum, and their usual byproducts: ignorance, avarice, and stupidity.

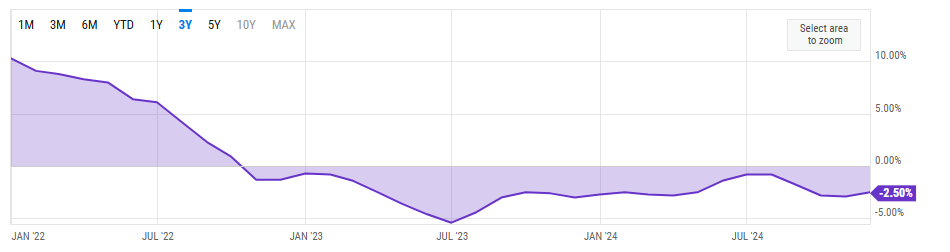

Lastly, you may wonder if I was bearish on the index overall, why would I place the better part of our portfolio in US securities. As a reminder, we look at individual companies in a bottom-up fashion, and I do tend to be value focused. Based on Morgan Stanley Thematic Strategy’s performance, 2024 wasn’t just not bullish for the value strategy, but was a downright bear market! Indeed, many of our core holdings substantially declined despite margin improvements or fundamentals stabilization, and as a result I believe these securities are sufficiently undervalued and have a potentially brighter future compared to their Chinese counterparts (and without the concomitant geopolitical risks), therefore the current capital allocation decision.

Misjudgment on Micro

The Longs:

I believe my more severe misjudgments come on the micro side. Two of my highest conviction bets, namely CSPC Pharmaceutical and PDD, both relentlessly declined more than 30%, and both names contributed significantly to our underperformance. Despite a major rally in Hang Seng index, other high conviction bets such as NetDragon Websoft and Tong Ren Tang Technologies that I have not extensively written about have declined ~20%.

For CSPC Pharmaceutical, I simply misjudged the severity of centralized procurement, and I have been misled by the management team’s optimism at the beginning of the year. The most recent round of centralized procurement, which feels like a slaughter for the participants but a political show for the executors has convinced me that the Chinese pharmaceutical industry is a mess. We have exited all our positions in the pharma space, including Livzon Pharma and Sinopharm Group, both of which we exited with a decent capital gain (though considerably less than S&P 500’s stellar return). In our view, the Chinese generic pharma industry is now worse than commoditized manufacturing, and overseas innovative drugs face geopolitical risk out of our control, therefore this industry is a pass for us, at least for the foreseeable future.

I currently do not believe I have made mistakes on the other three companies that I mentioned above. I could be wrong, but I am not going to take cues from one year’s stock movement to alter my thesis. You entrust capital to me because you believe in my judgment, and I have made a serious effort to collect all available information in a granular fashion to place bets on investments with attractive risk-reward. I am not going to go back-and-forth and easily change my viewpoint simply because the companies are recently out of favor with the market.

(Data Source: FactSet)

If a widely covered business has its forward earnings estimate revised upward 30% over the course of a year, how much should its stock price go up? (First Panel)

If another widely covered business has its forward earnings estimate revised upward by 2% over the course of a year, how much should its stock price go up? (Second Panel)

If the analysts’ consensus earnings are of any meaningful guide or to a minor extent reflects a most intelligent guess of what is likely to unfold, then I’d have to say that PDD’s 30% decline (corresponding to the first chart) and Apple’s 37% advance (corresponding to the second chart) are complete non-sense and as a portfolio manager I reserve my right to fundamentally ignore what the market tries to tell me and insist on keeping my head cool and unwaveringly focus on the intrinsic value of the businesses and let time by my judge.

For those who try to persuade me from this by arguing that Apple’s users love the product and it has an NPS of 72, let me point out the tremendous role Temu plays in taming inflation in western civilization and its even higher NPS score among regular purchases of 76. Despite all the gloom and doom among the investor base of PDD, we have found continued strong app engagement rate in China — ultimately, the earnings of a company come from its customers, not its investors. Most investors (speculators) are spineless animals and all it takes for them to alter their mind is three big white candles.

Of course, I could be proven wrong on PDD, but based on the facts and numbers I have collected and reviewed thus far, PDD remains my highest conviction bet entering 2025.

An error of omission could be my premature liquidation of our bank portfolio. Had we held on to the portfolio composed of names we have discussed before such as M&T Bank, Citizen Financial, and Western Alliance Preferred A Series till now, our performance would be improved by ~400-500 bps. However, regional banks as a group do not attract me as much as the industrial names we have accumulated recently. Private credit has gobbled up lots of regional banks’ territory in the post-GFC (great financial crisis) era and the loan book of regional banks are not as attractive. Coupled with inherent leverage, I decided to sell them as they approached fair value.

The Shorts:

I could find no excuse for my mistakes on the short side. If I had covered everything after I wrote my reflection on my short-selling journey in May, our performance would be better by ~300 bps. Our overall loss across accounts on the short side in 2024 is about 500 bps. Although I stopped conducting short-selling research on additional names, I sucked my thumb, believing my current shorts are going to bring us profit and protect us against a potential market correction, only to experience two additional short squeezes in October & November, leading to a couple of additional sleepless nights. After all the monetary losses that have been incurred, I have covered our shorts and decided to leave this “dark art” to folks more intelligent and competent. I believe the companies we shorted will ultimately crater, but I cannot afford to risk your capital to vindicate my ego — in the investment world, my ego is the most worthless thing amongst all. We may elect to hedge our portfolio using puts, but we will carry out our promise of only placing bets with favorable odds.

The Industrial Cycle is Our Bet for 2025

During the pandemic, the fragility of the global supply chain was displayed in plain sight, and decades of belief of JIT (just-in-time) delivery and lean manufacturing was put to test. Suppliers and manufacturers had an unprecedented backlog, and their pricing power was exceptionally strong. When the service industry was decimated by stay-at-home orders and mandates of social distancing across the globe, the industrial sector enjoyed a genuine boom.

When market participants were intoxicated by seemingly endless demand, and commentators reflected on how the notion of JIT should be thrown into a coffin, most of them forgot a Persian adage on impermanence — like all cycles, “this too shall pass”.

Jay W Forrester, the MIT scholar who founded the domain of “System Dynamics”, first introduced the concept of “bullwhip effect” in his seminal work, Industrial Dynamics, in 1961.

Hau L. Lee et al (1997) further built out the theory of “bullwhip effect”, and as we listened to tens of conference calls in the last six months confined to the industrial (and agricultural) domain, we became incrementally convinced that the industrial sector could be a bountiful place for us to fish. Many secular growth industrial companies sold off 20-50% in 2024 in the midst of a raging bull market, trading towards high-single-digit to low-double-digit normalized free cashflow yield, presenting attractive opportunities. We have accumulated sizeable positions in a number of them in Q4 2024, and we believe as the cycle inevitably turns and the secular growth story becomes intact in the next 12-18 months, these companies will generate satisfactory risk adjusted return for us. In addition, I believe some of the names we have bought are compounders; coupled with reasonable leverage, I feel less of an urge to sell them like the regional banks.

For starters, small perturbations in customer orders translate into larger and larger fluctuations as we traverse the supply-chain upward. There are, broadly speaking, two mechanisms at work here.

1). Behavioral Causes:

Each junction of the supply-chain may misperceive feedback and time delays. In other words, even though customer demand already starts to normalize, retailers may still extrapolate recent demand which leads to a stuffed channel. In addition, during the pandemic, customers stockpile lots of products in fear of running out, and such overreaction may be wrongly perceived to imply stronger secular demand when in reality the demand is of a more transitory nature.

2). Operational Causes:

Lee (1997)’s primary contribution comes from their dissection of the bullwhip effect from an informational angle. In other words, even absent behavioral causes, the information distortion in a supply-chain along is capable of generating bullwhip effect. For instance, each junction of the supply-chain adds a layer of safety stock to answer for an unexpected event, accentuated by the shortage experienced during the pandemic. The amount of safety stock, as a result, increases more towards the upper end of the supply-chain. In addition, due to a fear of shortage, players on the supply-chain may play the game of “over-ordering”, deliberately placing more orders than necessary with the explicit understanding of the fact that their orders won’t be fully honored. Other factors such as order batching to minimize procurement costs and price fluctuation due to inflationary pressure are also conductive to the bullwhip effect.

In a nutshell, there has been a lot of goods accumulated across the industrial supply-chain, and now that demand has normalized, the entire chain is under pressure to liquidate the excess inventory, leading to incrementally magnified demand destruction towards the upper-end of the chain.

What happened on the upside is happening on the downside as well, leading to linear extrapolation of diminishing demand, and projection of future EPS for industrial names have veered overly pessimistic, just the opposite three years ago. Stock prices collapsed, fingers started pointing, and some executives who had missteps either making acquisitions at the top of last cycle or those who tried to take advantage of their customers lost their jobs; restructuring programs were implemented, employees were laid off, and lean manufacturing & JIT delivery again became the norm, not completely dissimilar to what we saw in the tech cycle two years ago. Both channels and suppliers rushed to liquidate their inventory, reduced their working capital and overall production, and directed free cashflow towards either debt paydown or shareholder return. As an example, the three agricultural equipment manufacturers that we discussed in our 2Q letter, namely John Deere, Case New Holland, and Agco, have simultaneously idled selected plants, dramatically reduced production to allow their dealership’s inventory to clear. We like such concerted efforts, and believe the inventory issue is temporary in nature, presenting interesting contrarian opportunities to ride the long-term secular growth of agricultural equipment sales as well as the transition to precision farming.

Other than Case New Holland and Agco, we have identified a handful of other industrial plays, some reside in the “channels” category, while the rest reside in either manufacturers or parts suppliers.

For the channel businesses, we investigated various sectors’ days inventory outstanding, identifying sectors where we believe are recovering the fastest. For parts suppliers and manufacturers, we not only placed some emphasis on manageable inventory, but also focused on the mission criticality of their products as well as customer stickiness and barriers of entry. We also communicated with their management teams, conducted expert calls, while also engaged in conversations with their customers as well as competitors to validate our bull thesis as we built our positions. While we are uncertain as to the precise timing of a broader industrial recovery, we believe China’s fiscal stimulus in 2025 may reverse its trajectory of 26 consecutive months of PPI decline.

On the other side of the Pacific, we believe onshoring, rate cuts, and a more predictable and business-friendly environment under Donald Trump could lead to more active manufacturing activity in the US as well.

Even absent such catalysts on the horizon, we believe a gradual normalization coupled with a world that’s increasingly digitized and “intelligent” will ultimately reignite growth for these businesses. As our holdings are/will be better structured and streamlined, more efficient and shareholder friendly, coming off a low valuation means their potential upside could be substantial.

Conclusion

While I am deeply apologetic for our lackluster performance in 2024, especially my imprudent selection of short targets which, coupled with unfavorable odds and a fervently speculative market, led to considerable losses for myself and our investors, I remain optimistic with our current holdings. Our portfolio as a whole is trading at high-single-digit free cashflow yield as S&P 500 sets daily high almost once every five days. We have a long-term focused investor base that allows us to take a different stance, refusing to follow market-fad and almost idiotic trend-following. I am grateful for your commitment and I will try my best to live up to your expectation in the years ahead by staying rational, conducting due diligence, and strictly following the “first principle” of financial investing — the value of an asset is ultimately all its free cashflow generated over its lifetime discounted to the present.

We wish you a productive, healthy, and prosperous 2025!